Crypto Accounting Standard

PITF No. 38 Practical Solution on the Accounting for Virtual Currencies under the Payment Services Act

World’s First Crypto Accounting Standard?

On March 14, 2018, the ASBJ (Accounting Standards Board of Japan) issued PITF (Practical Issues Task Force) No. 38 “Practical Solution on the Accounting for Virtual Currencies under the Payment Services Act” (Crypto Accounting Standard).

My understanding is that this is the first stab an official accounting standard setting body has taken in releasing accounting guidance on how cryptos should be treated.

In this article, we aim to provide a summary of the Crypto Accounting Standard.

The numbers in parentheses that appear during the article represent the paragraph number from the original standard.

The original standard refers to cryptos as virtual currencies, so we have used that reference when translating excerpts from the standard.

The Crypto Accounting Standard is applicable to all companies that use crypto and is not limited to crypto exchanges.

It is useful for both preparers and users of financial statements to understand the Crypto Accounting Standard.

I Effective date and Scope

This PITF is effective for the annual period beginning after April 1, 2018.

Early adoption is permitted for the annual and interim period ending after the issuance of this PITF. (18)

The Standard addresses the accounting for virtual currencies as defined in the Payment Services Act, except for those that were issued by the entity itself (including its parent, subsidiaries and affiliates). (3)

II Accounting for Virtual Currencies Held on Its Own Behalf

1 Year end measurement (5-7)

| Does the Virtual Currency have an active market? | Year end measurement | Difference between cost |

| Yes | Mark-to-market | Recognized as gain or loss |

| No | Measure at cost. However, if disposal value < cost, the virtual currency should be measured using the estimated disposal value. This write-down should not be reversed in subsequent periods. | Recognized as loss |

Estimated disposal value: The estimate should be the amount that is certain to be recovered. If such an estimate is not practical, the disposal value is expected to be 0 or a memorandum value. (13)

2 Definition of “Active” Market

When there is a market in which transactions take place with sufficient frequency and volume to provide pricing information on an ongoing basis. (8)

Comment by the author: No quantitative thresholds are provided so management would have to use judgement when determining whether a crypto has an active market.

3 The market price of a virtual currency when an active market exists

Transaction price, per virtual currency, at the virtual currency exchange with which the entity has the largest transaction volume (9)

↓ When this exchange is the entity’s own exchange…

The transaction price of the entity’s own exchange can be used for year end measurement, only when it represents fair value. (10)

Comment by the author: The standard requires measurement using the transaction price at the virtual currency exchange in which the entity most frequently transacts with. The standard did not adopt the “principal market” and “most advantageous market” concepts.

4 Change in status of Active Market (11-12)

| Change in status | Accounting treatment | Difference recorded as |

| Active Market exists >> does not exist | Measure using the price observed immediately before the change in status. This becomes the cost. | Gain or loss in the period the status changed |

| Active Market does not exist >> exists | Mark-to-market | Gain or loss in the period the status changed |

III Accounting for Virtual Currencies Held by a Virtual Currency Exchange on Behalf of Its Customers

1 Recognition of Assets and Liabilities (14)

An asset is recognized at the market price when a virtual currency is deposited by a customer.

↓ At the same time…

A liability representing an IOU is recorded, measured at the same amount as the asset.

2 Year end measurement (15)

Measurement is performed following the same accounting for the Virtual Currencies Held on Its Own Behalf

↓

The liability representing the IOU is measured at the same amount as the asset

↓

As a result, no gain or loss is recognized from the year end measurement of Virtual Currencies Held by a Virtual Currency Exchange on Behalf of Its Customers.

Comment by the author: Customer crypto asset and corresponding liability is grossed up and is not netted on the balance sheet. Depending on how much the entity takes custody of customer crypto and also the crypto price movements, the entity’s liabilities could experience an unexpected increase.

Entities will need to monitor its liabilities as it may unintentionally become a large size company under Japanese Corporate Law (Capital equal to or more than 500 million JPY, or, Liabilities equal to or more than 20 billion JPY) by hitting the liability threshold.

Large size companies under Japanese Corporate Law have additional requirements that they have to abide by.

One critical requirement in the context of accounting is that large size companies require statutory financial statement audits by independent auditors.

IV When to Recognize Gain or Loss When Selling Virtual Currencies

When the agreement of the buying and selling of the virtual currency is established (13)

Comment by the author: The standard requires recognition of gain or loss from Virtual Currency sales when an agreement is established. Therefore, the following would be considered problematic when discussing the timing of revenue recognition.

× When the payment is confirmed on the blockchain

× When the proceeds were deposited

V Disclosure

1 Presentation(Income Statement)

The net amount, calculated as the selling proceeds less the cost of the virtual currencies sold, is presented on the income statement (16)

2 Notes (17)

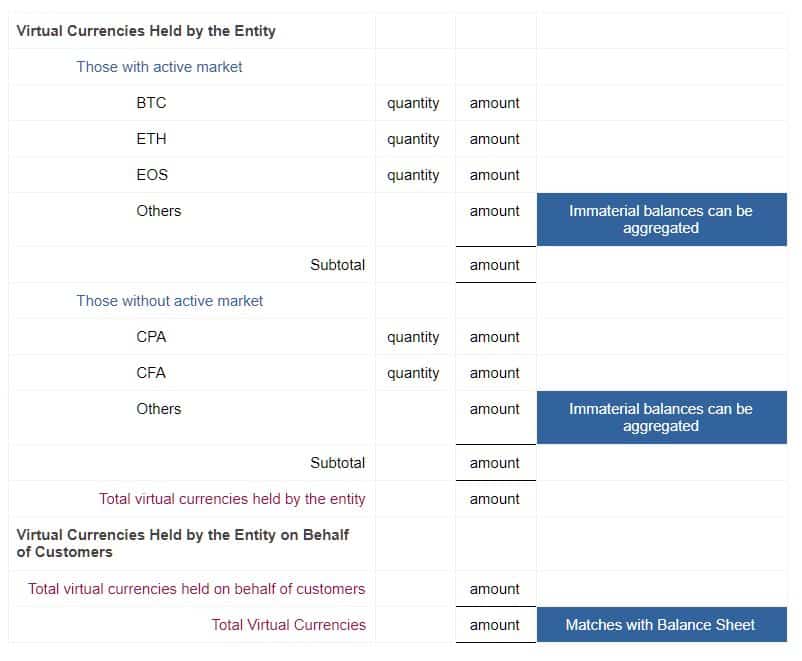

The following notes are required to be disclosed.

However, the notes may be omitted if the total balance sheet amount of virtual currencies is immaterial compared to the amount of total assets of the entity.

- The total balance sheet amount of virtual currencies held by the entity

- The total balance sheet amount of virtual currencies held by the virtual currency dealer held on behalf of its customers

- For virtual currencies held by the entity on its own behalf, separately disclose for those with an active market and those without an active market:

- quantity for each type of virtual currency

- amount for each type of virtual currency (virtual currencies with immaterial balances can be aggregated)

Comment by the author: Illustrative example of footnote