Knowledge Exchange

Need accounting, finance, auditing, Bitcoin, or crypto-related information?

We’ll offer it for zero fees!

All you have to do is tell us about your area of expertise and what you do best!

Tell us something we don’t know!

Approximate duration: 1 session / 1-2 hours

Method of interaction: In person or online (Google Meets)

Participation Fee: Free

Tokyo/Otemachi Crypto Roundtable

Learn about crypto after work at our office.

We’ll discuss crypto from a finance, accounting, tax and audit perspective.

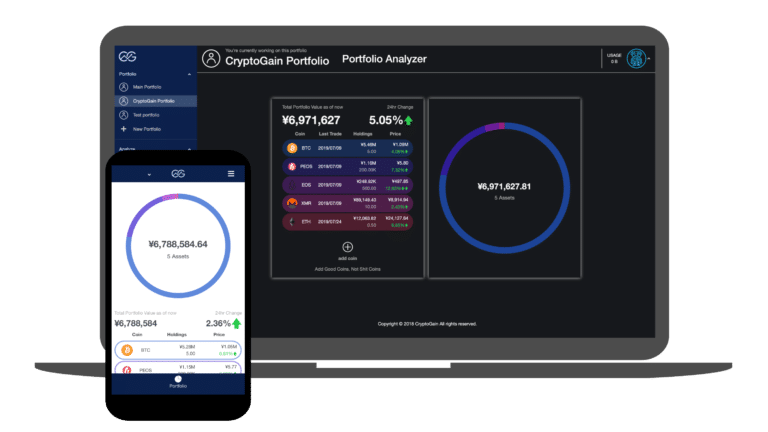

Track portfolio

Analyze portfolio performance

Calculate trade gains

Free to use

(We haven’t been able take the time to update the software in a while! If you’re interesting in developing the software with us, reach out!)

Services

Bitcoin Accounting

Accounting Consideration

Tax Consideration

Development of Accounting Tools

Internal Controls

Financial Statement Audits

Valuation of Derivatives

Blockchain Analysis

We create tools that use block explorer data (and Zerion) to perform analysis and data preparation for accounting purposes.

Compatible with Excel and Google Sheets.

Automation Tools

We create automation tools for accounting and financial statement analysis and audits.

Automated Dashboards

Compatible with Excel and Google Sheets.

Audit

Financial Statement Audit

Internal Control Audit (SOX)

Blockchain Audit

Internal Audit

Review

Agree Upon Procedures

Consulting

Accounting Compliance

SOX Implementation

Audit Assistance

Subsidiary Management

Foreign Business Expansion

Valuation

Business Valuation

Goodwill Valuation

Asset Valuation

Purchase Price Allocation

Impairment Testing

Stock Option Pricing

Crypto / Blockchain

CryptoGain

License Registration Support

Accounting Advisory

Segregation of Funds Audit

Financial Statement Audit

Financial Advisory

Business Forecasting/Budgeting

Pitch-deck Design

Annual Report Design

Analyst Report Design

Accounting Services

Bilingual CPAs will support the company’s financial reporting during the unexpected absence of directors, officers and key employees

News

BlockChainJam Podcast

Listen to my podcast where I talk with guests on topics ranging from cryptos, blockchains, finance, accounting and so much more.

Podcast twitter recent tweets

アメリカの上場会社がビットコインを買い始めている背景について9分の短いポッドキャストにまとめました。

アメリカの会計基準も企業のビットコイン取得を後押ししてる?!

アメリカの上場会社がビットコインを買い始めている背景

#Bitcoin のHalvingから120日経過しました。

現在のビットコインの価格はS2Fモデル価格を27%下回る水準で推移しています。

2016年のHalvingから120日後の2016/11/5のBTC価格はその時のS2Fモデル価格を25%下回っていました🤔

📈黄色い線がビットコインの実際の価格

📈青い線がS2Fモデルによる価格

Media

October 17, 2020, Newsweek Japan

October 24, 2019, Newsweek Japan

October 24, 2019, Newsweek Japan

October 17, 2019, Newsweek Japan

We're Hiring

Are you good with numbers?

Did you study accounting at school?

Are you good with Excel?

Come work with us!

See more info by clicking on the link below.

Reach out to us

We’d love to hear from you.

We will get back to you within 48 hours