Background

If you have any business relationships with customers in Japan, you may have heard that Japanese Consumption Tax (JCT) will be going through significant changes in 2023.

The TLDR (Too Long, Didn’t Read);

- Only Qualified Invoices can be deducted when your customer files a consumption tax return

- Only Qualified Invoice Issuers can issue qualified invoices

- In order to become a qualified invoice issuer, you need to register as such with the tax authorities by March 31, 2023

We’ll be covering the basics of JCT in future articles but in this article, we will focus on what these changes mean to you and what you should be doing.

March 31, 2023 is right around the corner and as you will see, this requires your immediate attention!

Let’s dive in.

Read till the end and you’ll find a link to a Qualified Invoice Template that I made for you! \

Who Does This Concern?

If you currently issue invoices to customers in Japan, this concerns you.

If the transaction between you and the Japanese customer is taxable, you have to act now.

Under JCT rules, some transactions are taxable while some aren’t.

That distinction will have to be made on a case by case basis and we’ll be covering the basics in future articles.

What is the issue?

Your Japanese customers won’t be able to claim consumption tax credits from purchases made from you.

From October 1, 2023 and onward, a “Qualified Invoice” will be required for Japanese businesses to claim a credit for consumption taxes that were paid.

A “Qualified Invoice” can only be issued by businesses that have registered with the Japanese Tax Authorities as a “Qualified Invoice Issuer”.

What Should I Be Doing?

Register as “Qualified Invoice Issuer”

Here is a simple to do list for you (items in bold letters are urgent):

- Asses whether transactions with your Japanese customer is subject to JCT

- If yes, register as a “Qualified Invoice Issuer” with the Japanese Tax Authorities

- Appoint a tax agent in Japan if you don’t have an office (physical establishment) in Japan

- Provide Japanese customers invoices that meet the requirements of a “Qualified Invoice” starting October 1, 2023

- Submit Japanese consumption tax returns

When is the deadline?

March 31, 2023

The Japanese Tax Authorities are requiring applications of “Qualified Invoice Issuer” to be submitted by March 31, 2023.

Invoices that meet the requirements of a “Qualified Invoice” will need to be sent to customers starting on October 1, 2023.

Who in Japan Can Help Me With This and Other JCT challenges?

I recently started a new project with professionals that I’ve gotten to know and have worked with on many projects in the past few years.

It’s called the Japan Professional Alliance (JPA for short).

These professionals include not just accountants and analysts like myself, but professionals in various areas of business.

Members at JPA include specialists in the following areas:

- Accounting

- Tax

- Legal

- Finance

- Marketing

- Web

- SNS

Business in this day and age has become extremely specialized.

JPA’s goal is to provide our clients with the best service, not just in the areas of accounting and finance, but also in areas that are important in doing business in this new era.

JPA can offer immediate assistance in complying with the new “Qualified Invoice System” and other Japanese Tax requirements that you may have.

We offer a comprehensive JCT solution that will help you meet the minimum requirements of JCT at an affordable price.

- Asses whether the transaction with your Japanese customer is subject to JCT

- Complete your registration as a “Qualified Invoice Issuer” with the Japanese Tax Authorities

- Provide you with an invoice template that meets the requirements of a “Qualified Invoice”

- Act as your tax agent in Japan

- Prepare and submit Japanese consumption tax returns

- Make tax payments to the tax authorities on your behalf

All work will be led by bilingual CPAs fluent in English and Japanese.

Japan Professional Alliance Website

Is there a mandatory JCT Qualified Invoice format?

The short answer is no, there is no mandatory format that is required by law or other regulations. (Source: Question 25 of the “Q&A on the storage method of eligible invoices etc. under the system for deductible input tax on consumption tax”)

As long as the document includes the “necessary information”, it will be considered a Qualified Invoice, regardless of the name of the document.

For example, such documents are often referred to as the following in practice:

- Invoices

- Delivery Slips

- Receipts

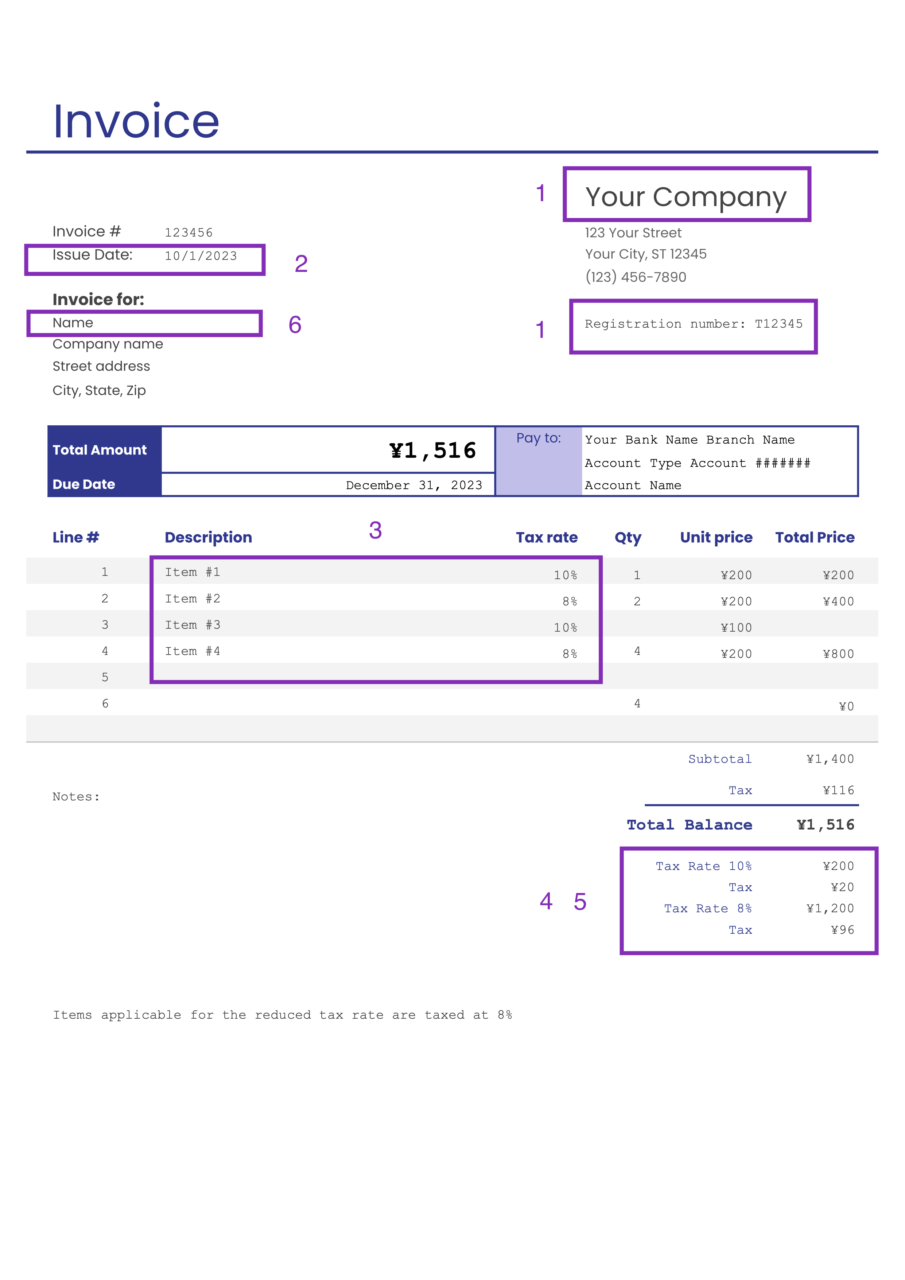

What information needs to be on the Qualified Invoice?

- The name and registration number of the issuer of the qualified invoice

- The date of transfer or other disposition of the taxable asset (*)

- The content of the asset or service related to the transfer or other disposition of the taxable asset (if the transfer or other disposition of the taxable asset is a

- transfer or other disposition of reduced-rate asset, the content of the asset and the fact that it is a transfer or other disposition of reduced-rate asset)

- The total amount of the tax-exempt or tax-inclusive value of the taxable asset for each tax rate, and the applicable tax rate

- The consumption tax amount, etc., for each tax rate

- The name of recipient of the invoice

* If a qualified invoice is prepared for multiple transfers or other dispositions of taxable assets made during a certain period within the same tax period, that period can be used instead of a single date.

If you already issue invoices in Japan, your invoice should already cover most of the items.

In most cases, what needs to be done additionally is slapping on the Registration Number.

What if my invoice is denominated in a foreign currency?

The yen amount of “the consumption tax amount, etc., for each tax rate” will need to be displayed on such invoices.

The other amounts may be in foreign currencies.

(Source: Question 59 of the “Q&A on the storage method of eligible invoices etc. under the system for deductible input tax on consumption tax”)

There are several ways to do the calculation:

- Calculate consumption tax etc. after converting the total of the tax-excluded amount of the taxable asset for each tax rate (foreign currency tax-excluded) into yen.

- Calculate consumption tax etc. after converting the total of the tax-inclusive amount of the taxable asset for each tax rate (foreign currency tax-excluded) into yen.

- Calculate consumption tax etc. in the foreign currency using the total of the tax-excluded amount of the taxable asset for each tax rate (foreign currency tax-excluded), then converting that into yen.

- Calculate consumption tax etc. in the foreign currency using the total of the tax-inclusive amount of the taxable asset for each tax rate (foreign currency tax-excluded), then converting that into yen.

The foreign currency conversion should be done in a way that is in accordance with income tax law and corporate tax law.

However, when such calculations are difficult when issuing the invoice, other reasonable methods may be used, with the condition that they are applied continuously.

Such methods may include using the exchange rate on the invoice issuance date or settlement date.

What will a Qualified Invoice Actually Look Like?

An actual qualified invoice could look something like this (prepared by the author).

JCT Qualified Invoice Sample Template

I made a JCT Qualified Invoice Sample Template using Google Sheets that anyone can use.

There’s both an English and Japanese version.

(Updated January 17, 2023: Added dollar denominated version (English))

(Updated February 1, 2023: Added bitcoin denominated version (English))

I’ll be creating a bitcoin denominated version if I have time!

Create a copy of the file on your Google Drive after opening the link below on your browser.

You can download in excel format too but some of the functions will break.