Reporting of Crypto Trades Made Easy

At Kimura CPA, we have been calculating gains and losses on crypto trades for individuals and funds since 2017.

Manually calculating gains and losses on crypto trades becomes virtually impossible as the number of assets and transactions increase.

To address this challenge, we developed a software to assist us in doing just that; calculate gains and losses on crypto trades.

That was how the CryptoGain project started.

Up until now, clients had to submit to us their trade data in order for us to deep dive into the calculation.

Our hope was to one day, make the calculation tool that we developed, available to all users.

With that goal in mind, we have been slowly but diligently, working in the background to turn CryptoGain into a web application that everyone can use.

The app version of CryptoGain is scheduled to include the following functions:

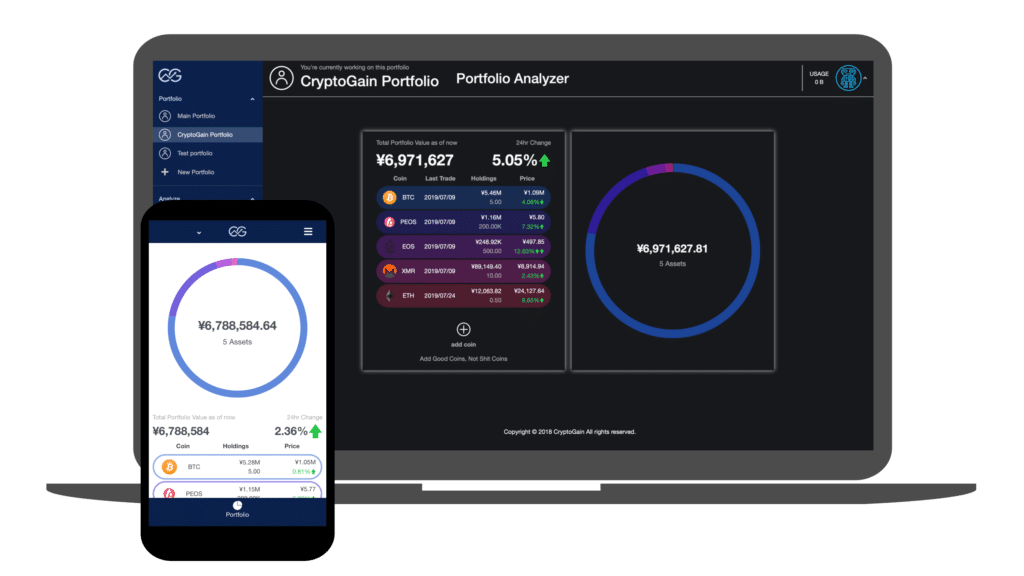

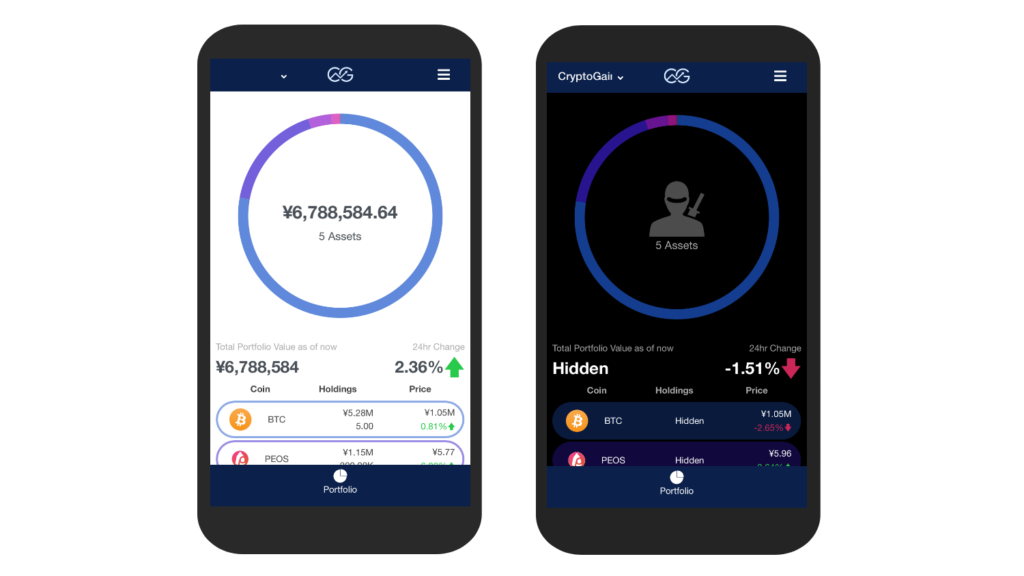

- Portfolio management (Released!)

- Portfolio performance analysis (Scheduled for 2019 Summer release)

- Calculation of gains and losses from crypto trades (Scheduled for release during 2019)

Sign Up Without Email! Available to Everyone!

You can start using the app version of CryptoGain right now without providing any private information.

You don’t even have to provide your email!

The app can be accessed from both your phone and computer.

No need to download any software.

We will continue to provide the legacy CryptoGain service

The app version of CryptoGain can handle standard transactions, but complex transactions will still need to be analyzed manually.

Examples of transactions that will still require human intervention would be those such as derivatives (futures, FX) and leveraged trades.

Human interaction also allows us to simulate multiple calculation scenarios, which can reveal powerful insights depending on your trading operation.

For those that require personal assistance for the above reasons, we will continue to provide our legacy CryptoGain service.

See below for details: