Introduction of the new service

We are excited to announce a new addition to our audit service line.

The new service will focus on Financial Statement Audits for US (United States) subsidiaries of Japanese companies.

In certain cases, the US subsidiaries of Japanese companies will need to have their financial statements audited by CPAs.

Such cases include the following:

- A subsidiary that was set up in the US was determined to be a significant component at the consolidated level and was included in the scope of the group audit

- Revenue or assets of the US subsidiary has been increasing the past few years and was included in the scope of the group audit starting this year

- The US entity that the group acquired was included in the scope of the group audit due to its materiality

We will also provide internal control audits and other financial statement audit related services.

Here are some of the examples of services that we will be providing:

- Assist in the preparation of the financial statements of the US subsidiary (USGAAP/IFRS analysis, new accounting standard analysis)

- Design the accounting policies for the US subsidiary

- Design and implement J-SOX structure to the US subsidiary (Internal control design, implementation, documentation, management testing)

- Impairment tests at the US subsidiary level (impairment of tangible and intangible assets, goodwill)

- Valuation of the US subsidiary (Investment valuation)

- Liaise with other experts engaged by the US subsidiary (lawers, tax accountants, etc.) and assess risk over financial reporting matters

- Assist in preparing for audits (for US subsidiaries that are having difficulties with audits, we can assist in preparing for audits so that the audit goes smoothly)

What you need to know about the new service

The team will be led by USGAAP, IFRS, SOX, US Audit, Group Audit professionals

The team members that will be assigned to the audits will include CPAs that specialize in financial statement audits in Japan and the US.

When performing group audits, the key to successful execution is open communication between the subsidiary audit team and the parent company audit team.

Team members that have over 10 years of audit experience at the Big 4 will ensure that the audit goes smoothly.

Team members will be physically located in both the US and Japan to ensure quick response times

The team members will be physically present in Japan (Tokyo) and the US (San Diego and Silicon Valley) so we can respond to your various needs.

Communication with the audit team members can be done in both English and Japanese.

The team members in Japan will provide Japanese management with the up to date status of the audit at the US subsidiary.

By providing management in both Japan and the US with consistent communication, we will ensure that there are no surprises at the end of the audit.

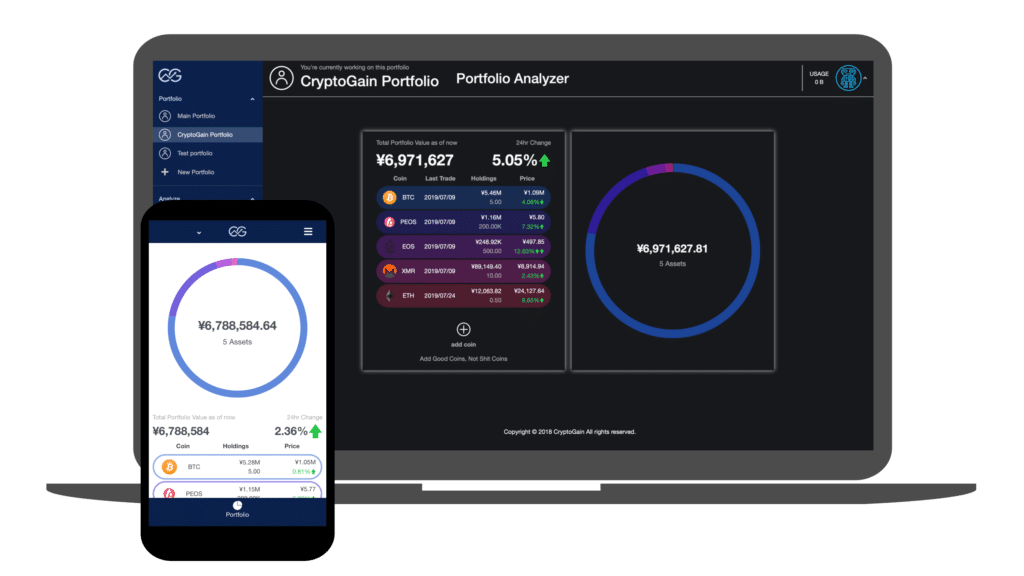

Decrease that number of audit hours by using a proprietary audit tool that syncs real time with QuickBooks

We have developed an audit tool that syncs with QuickBooks.

By importing real time accounting data from QuickBooks onto our audit platform, we can increase audit efficiency and decrease audit hours.

In addition, this will allow us to relieve some of the burden that is placed on Company’s accounting personnel during closing season by spreading audit work throughout the year (Continuous Auditing).

Why we are providing this new service

For Japanese companies that are thinking about expanding into the US market, financial statement audits of the US subsidiary is becoming a challenge.

If the auditor of the parent company is a large auditing firm, the audit of the subsidiary will be performed by a member firm in the US so it usually doesn’t become an issue.

However, if the auditor of the parent company is not part of a network with a member firm in the US, finding an auditor with the right skillset could be difficult.

In addition, if the US subsidiary is relying on third parties to prepare the financial statements, the parent company in Japan may not have a firm grip over the financial reporting process and the foundation for an audit may not be present at the subsidiary level.

This problem is further exacerbated if the US subsidiary is reporting under USGAAP or IFRS as acquiring the right talent could be a challenge.

Finding the right team with the appropriate experience and know-how is difficult and we wanted to provide a solution.

Introducing our Alliance Partners in the United States

In starting our new US Subsidiary Audit Service, we partnered with one of the best CPA firms with extensive experience working with Japanese companies in the US.

Together, we will ensure that our clients receive the best service, both in the US and in Japan.

Kevin Bee, CPA, A Professional Accountancy Corporation

Locations: San Diego, California and San Jose, California

Kevin Bee, CPA, has been focused on delivering quality financial statement audits with exceptional service to businesses of all sizes since 2002.

He leverages technology and deep experience to get the job done efficiently and add value while he’s at it.

He tailors the audit procedures to fit your unique business and needs, and delivers a report that investors, lenders, regulators, or anyone you choose to show the report to, can rely on.

Questions and Answers about our US Subsidiary Audit Service

If you have any questions about our US Subsidiary Audit Service, feel free to reach out.

Even if you currently have an auditor, we are happy to discuss and answer any questions that you may have.