Compared to the FAQ in 2017, Version 2 covers a wider range

On November 21, 2018, the National Tax Agency (NTA) published a guidance titled “Tax Treatment of Cryptocurrencies (Information)”.

This is the second time (the first was in 2017) that the NTA has officially expressed its views on calculating taxes for cryptocurrency in an FAQ format.

In this post, we will look at the contents of the FAQ that was recently released (Version2) one by one, compare that with the version that was released on December 1, 2017 (Version1), and add comments on any points of interest.

Before looking at the content of each FAQ, there are three major changes that can be seen in the cover and table of contents.

- The cover lists more departments within the NTA that are involved

- The title has changed

- There are more FAQ items

The cover lists more departments within the NTA that are involved

This is a comparison of the National Tax Agency’s divisions listed on the cover of last year’s and this year’s FAQs:

| 2017 | 2018 |

|---|---|

| Individual Taxation Division | Individual Taxation Division |

| Tax Consolidation Division | |

| Corporate Taxation Division | |

| Asset Taxation Division | |

| Asset Evaluation Planning Officer | |

| Consumption Tax Office |

In Version 1, the only division that was named in the FAQ was the Individual Taxation Division, but in Version 2 it has increased to six divisions.

In Version 1, the main focus was on individual income tax, but in Version 2 the scope has expanded.

The title has changed

The title of the FAQ has also changed due to the expansion of the scope of the FAQ from individual income tax.

| 2017 | 2018 |

|---|---|

| Calculating taxable income related to Cryptocurrency (Information) | Tax Treatment of Cryptocurrencies (Information) |

There are more FAQ items

The number of FAQ items has increased from nine in Version 1 to 21 in Version 2 due to the expansion of the scope of the FAQ.

In Version 2, the FAQ items were also divided into six sections:

- Income Tax and Corporate Tax

- Income Tax

- Inheritance Tax and Gift Tax

- Income Tax Withholding

- Consumption Tax

- Statutory Declaration

With these changes in mind, here are the items covered in Version 2 of the FAQ:

| No | Item | Changes from Ver1 |

|---|---|---|

| Income Tax and Corporate Tax | ||

| 1 | Sales of Cryptocurrency | Carried over (minor changes) |

| 2 | Purchase of Goods with Cryptocurrency | Carried over (minor changes) |

| 3 | Crypto-to-crypto Trades | Carried over (minor changes) |

| 4 | Acquisition Cost of Cryptocurrency | Carried over (minor changes) |

| 5 | Acquisition of Cryptocurrency Through Forks | Carried over (minor changes) |

| 6 | Acquisition of Cryptocurrency Through Mining | Carried over (minor changes) |

| Income Tax | ||

| 7 | Income Classification of Cryptocurrency | Carried over (minor changes) |

| 8 | Necessary Expenses of Cryptocurrency | New |

| 9 | Calculation of Taxable Income using the Annual Transaction Report | New |

| 10 | Contents of the Annual Transaction Report | New |

| 11 | Changes in the Method of Calculating the Acquisition Cost of Cryptocurrency | New |

| 12 | When the Purchase Price or Sale Price of the Cryptocurrency is Unknown | New |

| 13 | Treatment of Losses from Cryptocurrency Transactions | Carried over (minor changes) |

| 14 | Cryptocurrency Margin Trading | Carried over (minor changes) |

| Inheritance Tax and Gift Tax | ||

| 15 | When Cryptocurrency is Acquired Through Inheritance or Gift | New |

| 16 | How to Measure Cryptocurrency Acquired Through Inheritance or Gift | New |

| Income Tax Withholding | ||

| 17 | Payment of Salary, etc. Using Cryptocurrency | New |

| Consumption Tax | ||

| 18 | Treatment of Consumption Tax When Transferring Cryptocurrency | New |

| Statutory Declaration | ||

| 19 | Whether to Include Cryptocurrency in the Property and Debt Statement | New |

| 20 | How to Record the Value of Cryptocurrency in the Property and Debt Statement | New |

| 21 | Whether to Include Cryptocurrency in the Foreign Property Statement | New |

The reason why this FAQ is labeled as “information” is because it is not a law or regulation, but rather the view of the NTA.

Although it is not a law, the tax authorities in Japan will refer to this document when verifying the validity of tax calculations regarding crypto.

In practice, I expect various accounting and tax treatments to be based on this FAQ.

This hasn’t changed from Version 1.

Our comments will be inserted using blue text, and the rest is the original content of the FAQ.

The official document can be obtained at the following link:

仮想通貨に関する税務上の取扱いについて(情報)(平成30年11月21日)(PDF/430KB)

Income Tax and Corporate Tax

1 Sale of Cryptocurrency

Question

Please tell me how to calculate taxable income from the following cryptocurrency transaction.

(Example)

On March 9, I bought 4 bitcoin for JPY 2,000,000.

On May 20, I sold 0.2 bitcoin for JPY 110,000.

(Note) The above transaction does not take into account the transaction fees for buying and selling cryptocurrency.

Answer

In the above example, income is calculated by the following formula:

JPY 110,000 [selling price] – (JPY 2,000,000 ÷ 4BTC) [acquisition price per bitcoin] x 0.2 BTC [bitcoin sold] = JPY 10,000 [income](Note 1)

(Note 1)

If there are other necessary expenses, the amount will be the amount minus the amount of those necessary expenses.

When selling (converting to Japanese yen) the cryptocurrency you hold, income is the difference between the selling price of the cryptocurrency and the acquisition price of the cryptocurrency sold.

[Related laws and regulations, etc.]

Income tax law 36, 37

Corporate tax law 22, 22-2

Our comments:

I have no particular comments regarding the method of calculating the profit when converting cryptocurrency to Fiat (legal tender). (Same comment as Version1)

There are minor changes in terms (e.g. BTC to Bitcoin), but the biggest change is in the handling of transaction fees.

In Version 1, transaction fees explicitly included in the acquisition cost.

However, in Version 2 it is stated that “transaction fees are not taken into account”.

The handling of fees incurred when acquiring cryptocurrency is covered in “4 Acquisition Cost of Cryptocurrency”.

2 Purchase of Goods with Cryptocurrency

Question

Please tell me how to calculate taxable income from the following cryptocurrency transaction.

(Example)

March 9th Purchased 4 bitcoin for 2,000,000 yen.

September 28th Paid 0.3 bitcoin to purchase goods worth 162,000 yen (including consumption tax).

(Note) The above transaction does not take into account the transaction fees for buying and selling cryptocurrency.

Answer

In the above example, income is calculated according to the following formula:

162,000 yen [goods price(Note 2)] – (2,000,000 yen ÷ 4BTC) [acquisition cost per 1 bitcoin] × 0.3 BTC [bitcoin paid] = 12,000 yen(Note 1) [income]

(Note)

- If there are other necessary expenses, the amount will be the amount minus the amount of those necessary expenses.

- The “goods price” refers to the total amount to be paid in Japanese yen when purchasing the goods (including consumption tax, etc.).

If you use the cryptocurrency you hold for payment when purchasing goods, this means that you transferred the cryptocurrency you hold, and the difference between the price of the goods at the time of purchase and the acquisition cost of the cryptocurrency will be the income.

[Related laws and regulations, etc.]

Income tax law 36, 37

Corporate tax law 22, 22-2

Our comments:

I have no particular comments regarding the method of profit calculation.

However, in Version 2 it is stated that “transaction fees are not taken into account”, whereas Version 1 explicitly included transaction fees in the calculation example.

This change is the same as in “1 Sales of Cryptocurrency”.

The comment below has been carried over from my commentary for Version 1.

It is not practical to calculate profit and loss every time one pays using bitcoin regularly in their daily lives.

Yes, it is true that the same tax rules apply to the use of foreign currencies.

But few people calculate and report exchange gains and losses when using foreign currencies during their holiday vacations in foreign countries.

We believe that a de minimis rule is necessary to exempt transactions below a certain amount.

3 Crypto-to-crypto Trades

Question

Please tell me how to calculate taxable income from the following cryptocurrency transaction.

(Example)

On March 9, I purchased 4 bitcoin (A) for 2,000,000 yen.

On November 2, I used 1 bitcoin to purchase 10 XRP (B). The market value of XRP at the time of transaction was 1 XRP = 60,000 yen.

(Note) The above transaction does not take into account the transaction fees for buying and selling cryptocurrency.

Answer

(60,000 yen x 10 XRP) [purchase price of B(Note 2)] – (2,000,000 yen / 4BTC) [acquisition cost per 1 A] x 1BTC [bitcoin paid] = 100,000 yen(Note 1) [income]

(Note)

- If there are other necessary expenses, the amount will be the amount minus the amount of those necessary expenses.

- “Purchase price of B” refers to the total amount to be paid in Japanese yen when purchasing the same quantity of cryptocurrency B.

If you use your own cryptocurrency to purchase another cryptocurrency B, you are purchasing cryptocurrency B with cryptocurrency A.

Therefore, taxable income shall be calculated in a way similar to “2 Purchase of Goods with Cryptocurrency”.

[Related laws and regulations, etc.]

Income tax law 36, 37

Corporate tax law 22, 22-2

Our comments:

Here too, a change has been made to “not take into account” the transaction fees.

The handling of fees incurred when acquiring cryptocurrency is covered in “4 Acquisition Cost of Cryptocurrency”.

The comment below has been carried over from my commentary for Version 1.

I have no particular comments on the calculation method for profits related to crypto-to-crypto trades.

I believe most countries consider crypto-to-crypto exchanges as a taxable event.

However, I think a little more effort could have been made in the following two points.

First, it is often unrealistic or difficult to calculate gains and losses for each crypto-to-crypto exchange transaction.

In the case of listed stocks or FX, a transaction occurs and is completed within one brokerage account.

In this case, the calculation of trading gains and losses is easy and can be easily checked in most cases in the service provider’s user account information.

Even if one is using multiple accounts, one can generally determine the overall gain and loss by simply totaling the gains and losses of each account.

However, in the case of cryptocurrencies, one can freely send cryptocurrency between exchanges.

If one sends cryptocurrency purchased from one exchange to another exchange, the receiving exchange does not know the acquisition cost of the cryptocurrency.

Since there is no information on the acquisition cost, it is impossible for the receiving exchange to calculate gains and losses.

Therefore, it is not possible to determine the overall gain and loss by simply summing up the gain and loss data for each exchange if one is using multiple exchanges.

If one has a small number of transactions or is just using a few exchanges, one can use a spreadsheet to try to calculate gains and losses.

As the number of transactions or exchanges used increases, it becomes unrealistic or difficult to perform such calculations.

The second reason is a little more conceptual.

When exchanging one asset for another, the assumption is that it goes through yen once.

If there is a price difference between the assets being exchanged, a gain or loss is realized.

This is easy to understand when thinking of selling Apple stock to buy Google stock (both listed stocks).

One can’t trade AAPL with GOOG directly, they first sell AAPL for fiat, recognize any gain or loss at this point, and use that fiat to buy GOOG.

The thing with cryptocurrency is that BTC and ETH can be traded directly.

In most cases, users do not have the intention of realizing gains or losses when making these transactions.

Generally speaking, cryptocurrency does not give its holders any rights or represent any obligations, unlike financial products or fiat currencies .

In simple terms, holding cryptocurrency means holding a random string of characters called a Private Key.

Exchanging cryptocurrency for cryptocurrency is simply exchanging one string of characters for another.

It is similar to a person with an orange exchanging it for a person with an apple.

Even if the tax law is strictly applied in such a case, it may be subject to taxation.

But from a technical perspective, it seems awkward to me that merely exchanging a string of random letters would be considered a taxable event (this is akin to generating taxable events when exchanging email).

From a practical perspective and a conceptual perspective, I think it is appropriate to tax cryptocurrency when exchanged for fiat.

4 Acquisition Cost of Cryptocurrency

Question

I purchased bitcoin on a Japanese exchange and paid a transaction fee. In this case, what is the acquisition cost of the purchased cryptocurrency?”

(Example of cryptocurrency transactions for one year)

On September 1, I purchased 4 bitcoin for JPY2,000,000. Transaction fee was JPY540 (including consumption tax).

Answer

The acquisition cost of the acquired cryptocurrency in the above example is JPY2,000,540.

This includes the transaction fees and any other incidental expenses in addition to the payment consideration.

Reference: For a corporation that is a taxable business entity (applying the tax-excluded accounting method) and conducts the above example transaction, what is the acquisition cost of the purchased cryptocurrency?

Answer

The acquisition cost of the cryptocurrency in the above example is JPY2,000,500(Note 1, 2).

(Note)

- Under the Consumption Tax Law, the transfer of cryptocurrency and other payment methods is not subject to taxation, but the transaction fee paid to a cryptocurrency exchange operator as a commission for the transaction is considered a consideration for providing services related to the brokerage, and is subject to consumption tax.

- If the person conducting the transaction in this case is a taxable enterprise under the Consumption Tax Law and applies the tax-excluded accounting method, the amount of consumption tax and other taxes included in the transaction fee (JPY 40 = JPY 540 x 8/108) and the amount of the consideration for the taxable transaction (JPY 500 = JPY 540 – JPY 40) are divided, and the acquisition price of the purchased cryptocurrency is the sum of the amount of the consideration for the taxable transaction (JPY 2,000,500 = JPY 2,000,000 + JPY 500).

[Related laws and regulations, etc.]

Income tax law 36, 37

Corporate tax law 22

Handling of corporate tax with the implementation of the Consumption Tax Act, etc. (Direct Law 2-1 dated March 1, 1989) 1-3

Our comments:

In Version 1, information was provided on the calculation of acquisition cost using the moving average method and the total average method.

In Version 2, the focus of the question has changed to the handling of transaction fees when acquiring cryptocurrencies.

The treatment of including transaction fees incurred when acquiring cryptocurrency in the acquisition price has not changed from Version 1.

The new information being provided in Version 2 is regarding the handling of consumption tax.

The acquisition cost should be calculated by extracting the consumption tax part from the transaction fees, but it will become quite complicated if the transaction data from the exchange is not formatted to accommodate this.

If you actually start calculating the acquisition cost, you will quickly realize that the handling of transaction fees is complex.

Transaction fees are displayed in various formats in the transaction data depending on the exchange.

(Examples)

- fees are generated separately from the order amount

- fees are deducted from the order amount

- fees are incurred in the base currency

- fees are incurred in the trade currency

- fees are displayed as negative (rebate)

- fees are displayed as rewards in an exchange token

It will be very tedious to sort through each of these scenarios and build logic to calculate total gains and losses.

5 Acquisition of Cryptocurrency Through Forks

Question

If one acquires a new cryptocurrency that was born as a result of a chain fork, will this acquisition generate taxable income under individual income tax or corporate tax?

Answer

If one acquires a new cryptocurrency through a split (fork) of an existing cryptocurrency, no taxable income will arise.

Under the Income Tax Act, when acquiring something with economic value, the income amount is calculated based on the market value at the time of acquisition.

However, regarding the new cryptocurrency acquired as a result of a chain fork mentioned in the above question, it is considered that there was no trading market at the time of the fork and the cryptocurrency did not have value at that time.

Therefore, no income will be generated at the time of acquisition, and income will be generated when the new cryptocurrency is sold or used.

In that case, the acquisition price will be 0 yen.

The same goes for corporate tax.

The acquisition cost of the newly acquired cryptocurrency as a result of a split (fork) is 0 yen, and it is considered that there is no amount of profit to be included when calculating taxable income.

[Related laws and regulations, etc.]

Income tax law 36

Corporate tax law 22

Our comments:

In Version 2, bits of language on corporate tax was added, but the content itself is basically the same as Version 1.

The comment below has been carried over from my commentary for Version 1.

In the FAQ, it is stated that upon the fork, there is no market and the asset has no value, so the acquisition price is considered to be zero yen, and as a result, there is no income at the time of acquisition.

However, as the existing assumption is that, if an asset is acquired, the income amount is calculated based on the market value at the time of acquisition.

I consider applying this assumption to cryptocurrencies to be an issue in some cases.

Blockchain forks occur at certain frequencies due to how blockchains work.

For example when blocks are consecutively mined in a short period of time, this could lead to forks in the chain.

In the above example, the chain that is ultimately recognized as valid by the majority of nodes in the network is preserved, and the fork chain is discarded.

Therefore, new coins that have value do not arise from all forks.

However, many blockchains are open source and can be freely forked by anyone.

It is possible that a fork could occur without the taxpayer’s knowing.

The taxpayer could unknowingly acquire a cryptocurrency with value.

Also, even if a spot market did not exist at the time a new cryptocurrency was created, it is possible that a price for the cryptocurrency could be formed in a derivative market for the cryptocurrency.

As pointed out in the comments for FAQ 3, we believe that by taxing at the time of exchange for fiat currency or use, it simplifies the calculation of taxable income and protects taxpayers.

6 Acquisition of Cryptocurrency Through Mining

Question

If cryptocurrency is obtained through mining, is the income subject to income tax or corporate tax?

Answer

Income from cryptocurrency obtained through mining is subject to income tax or corporate tax.

For income tax, If one acquires cryptocurrency through mining, the income from it is considered either business income or miscellaneous income.

In this case, the amount of income is calculated by subtracting necessary expenses (costs incurred through mining or other means) from the amount of revenue (the market value of the cryptocurrency at the time it was acquired through mining or other means).

For corporate tax, If one acquires cryptocurrency through mining or other means, the value of the acquired cryptocurrency (market value) will be added and the costs incurred for mining or other means will be deducted when calculating taxable income.

If onesells or uses the cryptocurrency one acquired through mining or other means, the acquisition cost when calculating taxable income would be the market value of the cryptocurrency at the time it was acquired through mining or other means.

[Related laws and regulations, etc.]

Income tax law 27, 35, 36, 37

Corporate tax law 22, 22-2

Our comments:

Not much change from Version 1 other than the addition of treatment for corporate tax.

The comment below has been carried over from my commentary for Version 1.

It seems like a reasonable conclusion at first glance, but upon further thought, there appears to be a few issues.

If one interprets receiving bitcoin (cryptocurrency) as payment for providing the service of mining, then yes, the received bitcoin would be considered income.

However, mining itself is not a service, and there is no organization like a company or individual that can be considered the recipient of the service.

Mining bitcoin is merely generating random numbers using a computer.

It is called mining as an analogy because it shares certain similarities as gold mining.

Gold mining companies and oil mining companies do not consider mining gold or oil itself as their business.

They consider selling the mined commodities as their business and income tax is also recognized not at the time of mining, but at the time of sale.

If we think of bitcoin mining in the same way as commodity mining, it seems reasonable to recognize taxable income at the time of sale or use, not at the time of mining.

Income Tax

7 Income Classification of Cryptocurrency

Question

Under Income Tax Law, what category of income will gains from cryptocurrency transactions be classified as?

Answer

In general, gains resulting from the use of cryptocurrencies are classified as miscellaneous income.

Gains and losses (gain or loss recognized in relation to the relative relationship between domestic currency or foreign currency) arising from cryptocurrency transactions are classified as miscellaneous income, unless:

- the cryptocurrency transaction itself is considered as a business(Note 1)

- the cryptocurrency transaction is performed in conjunction with acts that are the basis for various types of income such as business income(Note 2)

(Note)

Cryptocurrency transaction itself is considered as a business”, for example, if it is objectively clear that the cryptocurrency transaction is being conducted as a business, such as if the income is used to support one’s livelihood, the income classification would be business income.

“The cryptocurrency transaction is performed in conjunction with acts that are the basis for various types of income such as business income”, for example, if the business income earner owns the cryptocurrency as a business asset, and is using it as a means of payment when purchasing inventory etc.

[Related laws and regulations, etc.]

Income tax law 27, 35, 36

Our comments:

Not much change from Version 1 other than a few words here and there.

The comment below has been carried over from my commentary for Version 1.

Since the FAQ states that it is miscellaneous income “except when it is generated in conjunction with acts that are the basis for various types of income such as business income”, I think the point is that it can be reported as other income (business income or miscellaneous income) if it can be objectively proven.

On the other hand, the word “in general” is likely to be a hurdle in practice.

8 Necessary Expenses of Cryptocurrency

Question

In the case of reporting income from the sale of cryptocurrency, what expenses are considered necessary business expenses?

Answer

Necessary expenses when calculating taxable income from the sale of cryptocurrency include, for example, the following costs

- Acquisition cost of the cryptocurrency sold

- Transaction fees paid for the sale of the cryptocurrency

In addition, the cost of using the internet or smart phones, the cost of purchasing a computer, etc. can also be included in the necessary expenses, as long as the amount of such expenses is deemed to be necessary for the sale of the cryptocurrency.

In principle, income from the sale of cryptocurrency is classified as miscellaneous income, as described in “7 Income Classification of Cryptocurrency”.

The amount that can be included in the necessary expenses is (1) the cost of sales corresponding to the amount of gross income and other expenses directly required to earn the amount of income, and (2) the amount of selling expenses, general administrative expenses, and other expenses incurred in the business that should generate the income in the year.

Please note the following items regarding necessary expenses.

- For assets such as a personal computer that have a useful life of more than one year and exceed a certain monetary value, the necessary expenses should be divided over the entire useful life of the asset (such expenses are called “depreciation expenses”), rather than being expensed in a lump sum for the year.

- For personal business, expenses that are related to both household and business activities (such expenses are called “household-related expenses”) should be based on transaction records. Expenses related to both household and business affairs may be included in necessary expenses only if they can be clearly classified as directly necessary for the performance of the business based on the transaction records.

[Related laws and regulations, etc.]

Income tax law 37, 45

Income tax law enforcement ordinance 96

Our comments:

This is a new item introduced in Version 2.

Judgment is required when determining what expenses can be included in necessary expenses.

The best approach would be to keep all your receipts during the year and consult with your tax accountant.

9 Calculation of Taxable Income using the Annual Transaction Report

Question

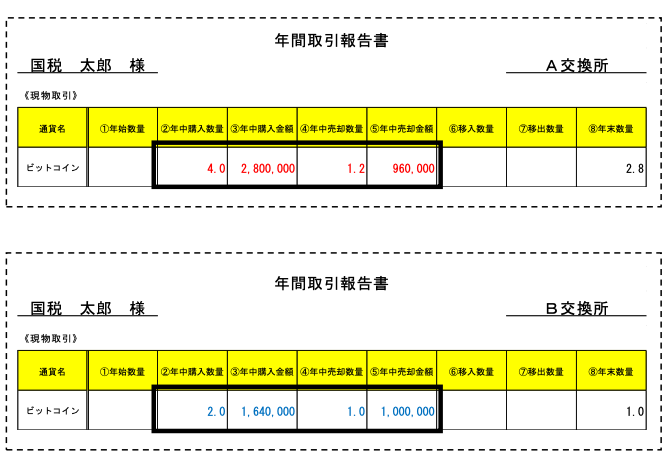

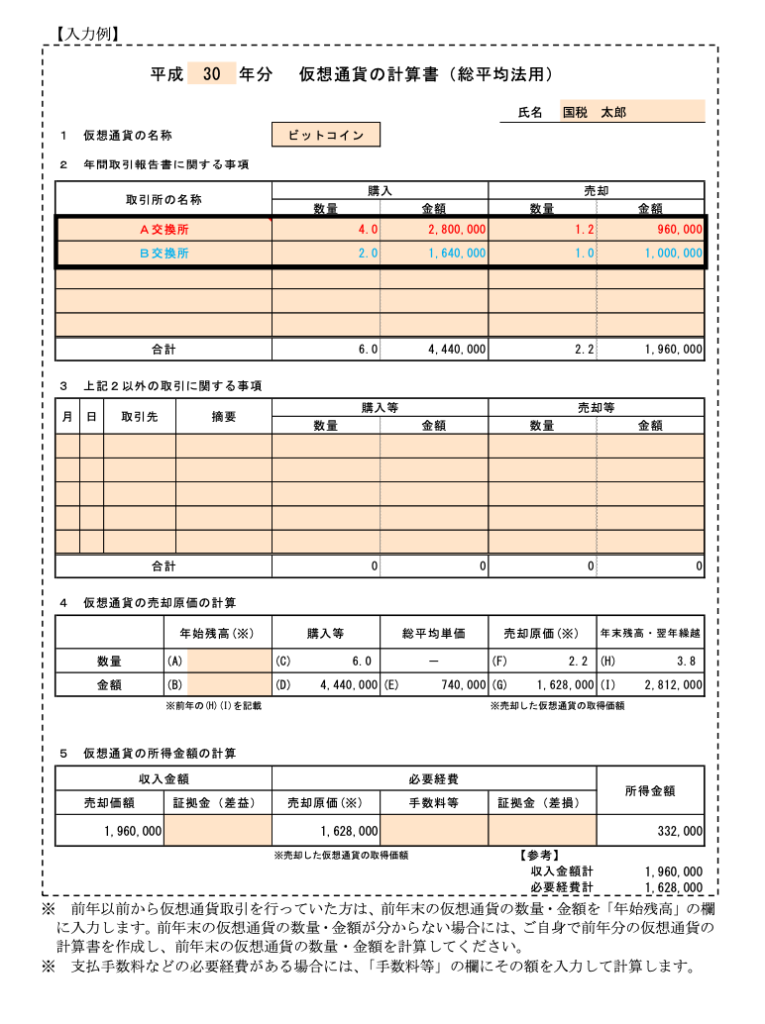

Cryptocurrency exchange A and B sent the following annual transaction reports. Please teach me how to calculate the amount of income from cryptocurrency using these annual transaction reports.

Answer

By inputting the red and blue portions of the annual transaction report into the “Calculation Sheet for Cryptocurrency (using the average cost method)” published on the National Tax Agency homepage, you can easily calculate the amount of income.

In the above case, the amount of income from cryptocurrency is 332,000 yen.

Please refer to the next page for an example of calculating the Calculation Sheet for Cryptocurrency (using the average cost method).

[Related laws and regulations, etc.]

–

Our comments:

This is a new item introduced in Version 2.

If you use only a few exchanges, these reports may make it easier to calculate the amount of taxable income.

Needless to say, foreign exchanges do not provide such a report, so it may not be useful for people who use many overseas exchanges.

In addition, as mentioned in the following sections, the moving average method is usually more advantageous, so this report may not be very useful for those who use the moving average method.

10 Contents of the Annual Transaction Report

Question

An annual transaction report was sent from a cryptocurrency exchange, but what is recorded in this annual transaction report?

Answer

- Beginning quantity for the year: The quantity of cryptocurrency holdings as of January 1 of that year

- Purchased quantity during the year: The quantity of cryptocurrency purchases made during the year

- Purchased amount during the year: The amount of money spent on cryptocurrency purchases during the year

- Sold quantity during the year: The quantity of cryptocurrency sales made during the year

- Sold amount during the year: The amount of money received from cryptocurrency sales during the year

- Transfer-in quantity: The quantity of cryptocurrency received in the account other than purchases made during the year

- Transfer-out quantity: The quantity of cryptocurrency paid out from the account other than sales made during the year

- End-of-year quantity: The quantity of cryptocurrency holdings as of December 31 of that year

- Total profit or loss: The total amount of profit or loss from cryptocurrency margin trading for the year

- Transaction fee: The amount of transaction fees paid to the cryptocurrency exchange during the year

* In cases where cryptocurrency sales, purchases, etc. are made using a foreign currency, the amount converted into yen based on the TTM of the telegraphic trading market at the time of the transaction is the basis for each item.

In the case of the following transactions, the contents of each column are as follows:

1. In the case of receiving cryptocurrency from a cryptocurrency exchange for free

“Sold quantity during the year”: –

“Sold amount during the year”: The value (market value) of the cryptocurrency received

“Purchased quantity during the year”: The number of cryptocurrency received

“Purchased amount during the year”: The value (market value) of the cryptocurrency received”

2. When settling with cryptocurrency

- If you converted the cryptocurrency to fiat currency and made the payment through a cryptocurrency exchange:

“Annual Sale Quantity”: The quantity of cryptocurrency that was converted to fiat currency

“Annual Sale Amount”: The value (market value) of the cryptocurrency that was converted to fiat currency - If you made the payment directly withthe cryptocurrency:

“Transfer Out Quantity”: The quantity of cryptocurrency used for the payment

3. If you exchanged cryptocurrency A for cryptocurrency B through a cryptocurrency exchange:

A cryptocurrency’s “Annual Sale Quantity”: The quantity of cryptocurrency A that was exchanged

A cryptocurrency’s “Annual Sale Amount”: The value (market value) of the cryptocurrency B that was obtained

B cryptocurrency’s “Annual Purchase Quantity”: The quantity of cryptocurrency B that was obtained

B cryptocurrency’s “Annual Purchase Amount”: The value (market value) of the cryptocurrency B that was obtained

Please note that the format of the annual trading report may vary depending on the cryptocurrency exchange.

[Related laws and regulations, etc.]

–

Our comments:

This is a new item introduced in Version 2.

I have no particular comments on this item.

11 Changes in the Method of Calculating the Acquisition Cost of Cryptocurrency

Question

In last year’s declaration, I calculated the acquisition cost of the sold cryptocurrency using the moving average method, but it is difficult to calculate, so can I change to the total average method for this year’s declaration?

Answer

It is possible to change the calculation method for the acquisition cost of the sold cryptocurrency, assuming that the “total average method” will be continued in future declarations.

Although it is generally appropriate to calculate the acquisition value of the sold cryptocurrency using the “moving average method,” it is considered that it is not a problem to use the “total average method”, as long as it is applied continuously.

Therefore, those who have been calculating the acquisition cost of the sold cryptocurrency using the “moving average method” can change to the “total average method.”

Note that if you change from the “moving average method” to the “total average method” as in your question, the “quantity and acquisition cost of cryptocurrency at the beginning of the year” in the calculation of the acquisition cost of the sold cryptocurrency for the current year will be based on the “quantity and acquisition value of cryptocurrency at the end of the previous year calculated using the moving average method”.

[Related laws and regulations, etc.]

–

Our comments:

This is a new item introduced in Version 2.

The comment below has been carried over from my commentary for Version 1.

In the FAQ, both the moving average method and the total average method (with the condition of continuous application) are permitted, and the moving average method is considered “appropriate”.

However, there are other methods of calculating cost that are considered appropriate besides the moving average method and the total average method.

The first-in, first-out method and the individual cost method are examples.

In the United States, the first-in, first-out method is the basis for calculating the acquisition cost of cryptocurrency.

The individual cost method is also permitted under the condition that transaction records are properly maintained and the cryptocurrency itself that was the subject to the transaction can be uniquely identified.

Cryptocurrencies using the UTXO (Unspent Transaction Output) model, such as Bitcoin, allow individual identification of the cryptocurrency that was the subject of the transaction. (Ethereum is account-based and does not have UTXO, so it is not possible to individually identify the ETH that was the subject of the transaction)

Since the assets that were the subject of the transaction can be individually identified, it should be said that the individual cost method most accurately represents the cost and is most appropriate as the cost calculation method.

bitcoin is an asset with completely new properties that have never existed before.

Instead of simply applying the framework for existing assets, it is better to discuss how to faithfully represent the actual substance of the transaction.

The other point of interest is the section where it says “fractions of less than 1 yen that occur in the acquisition cost calculation may be rounded up”

If the cost increases, the gain will be calculated less, so the conclusion is that rounding up the fraction is advantageous.

Whether the moving average or the total average is advantageous is case-by-case.

Except in cases where the result is clear, it seems best to adopt the moving average method, considering the benefits of fraction rounding.

12 When the Purchase Price or Sale Price of the Cryptocurrency is Unknown

Question

I have traded cryptocurrency this year, but I have not kept a record of the transactions, so I do not know the purchase price or sale price of the cryptocurrency. Is there a way to check these prices?

Answer

You can confirm the purchase price and sale price of cryptocurrency transactions according to the following categories:

1 Cryptocurrency transactions through domestic cryptocurrency exchanges

For cryptocurrency transactions after January 1, 2018, the National Tax Agency requests that cryptocurrency exchanges provide an “Annual Trading Report” containing the following information to individual taxpayers.

Annual Purchase Quantity: The quantity of cryptocurrency purchased during the year

Annual Purchase Amount: The amount of money spent on purchasing cryptocurrency during the year

Annual Sale Quantity: The quantity of cryptocurrency sold during the year

Annual Sale Amount: The amount of money received from selling cryptocurrency during the year

If you do not have an Annual Trading Report, please request a new one from the cryptocurrency exchange.

(Note) For transactions before 2018, an Annual Trading Report may not have been provided. In that case, please refer to the following category 2 to confirm the purchase price and sale price of cryptocurrency yourself.

2 Cryptocurrency transactions other than those in category 1 (transactions through foreign cryptocurrency exchanges, transactions between individuals)

To confirm the purchase price and sale price of individual cryptocurrencies, you can use the following methods, for example:

Confirm the purchase price and sale price of cryptocurrency by checking the withdrawal status of the bank account used to purchase cryptocurrency and the deposit status of the bank account used to sell cryptocurrency.

Confirm the purchase price and sale price of cryptocurrency by using the transaction history of cryptocurrency transactions and the transaction market published by the cryptocurrency exchange (Note).

(Note) In the case of transactions between individuals, use the transaction market of the cryptocurrency exchange that you mainly use. If the correct amount is found after submitting the final tax return, please correct the content of the final tax return (request for a revision or correction).

[Related laws and regulations, etc.]

–

Our comments:

This is a new item introduced in Version 2.

I have no particular comments on this item.

13 Treatment of Losses from Cryptocurrency Transactions

Question

I incurred a loss in the amount of miscellaneous income through cryptocurrency trading. Can this loss be used to offset other income such as salary income?

Answer

A loss incurred in the calculation of miscellaneous income cannot be used to offset other income.

Under the Income Tax Act, income that can be used to offset other income includes real estate income, business income, mountain forest income, and transfer income.

Since miscellaneous income does not fall under these categories of income, a loss incurred in the calculation of miscellaneous income cannot be consolidated with other income, even if there is such a loss.

[Related laws and regulations, etc.]

Income tax law 69

Our comments:

The content is pretty much the same as Version 1.

While losses cannot from miscellaneous income can’t be used to offset income from other income categories, that changes if the income is classified as other than miscellaneous, such as business income or transfer income.

14 Cryptocurrency Margin Trading

Question

Will cryptocurrency margin trading be subject to the separate taxation system for declaration, similar to foreign exchange margin trading (commonly known as FX)

Answer

Margin trading of cryptocurrency is not subject to separate reporting taxation.

Income from margin trading of cryptocurrency is not subject to separate reporting taxation, so it will be reported under comprehensive taxation.

Under the Special Tax Measures Act, separate reporting taxation (special taxation of miscellaneous income related to futures trading, etc.) applies to 1 commodity futures trading, 2 financial product futures trading, and 3 covered warrant acquisition, which are based on the Financial Instruments and Exchange Act, among others.

Foreign exchange margin trading (so-called FX) falls under financial product futures trading, so it is subject to separate reporting taxation.

On the other hand, margin trading of cryptocurrency does not fall under any of these transactions, so it is not subject to separate reporting taxation and the income from such transactions will be reported under comprehensive taxation.

[Related laws and regulations, etc.]

Income tax law 35

Special Tax Measures Act 41-14

Our comments:

The content is pretty much the same as Version 1.

The comment below has been carried over from my commentary for Version 1.

I am personally opposed to special tax treatments in general.

Lowering the tax rate is never a bad thing, but tax exemptions that favor only a certain group of people are not fair.

Inheritance Tax and Gift Tax

15 When Cryptocurrency is Acquired Through Inheritance or Gift

Question:

What is the tax treatment for cryptocurrency acquired through inheritance or gift?

Answer:

Inheritance tax or gift tax will be imposed when cryptocurrency is acquired through inheritance, bequest, or gift from the inherited person, etc.

The Inheritance Tax Law provides that an individual will be subject to inheritance tax or gift tax when economic assets with a value that can be estimated in money are acquired through inheritance, bequest, or gift.

As for cryptocurrency, it is specified in the Payment Services Act as an “asset with a value that can be used to settle a debt to an unspecified person,” so if cryptocurrency is acquired through inheritance, bequest, or gift from the inherited person, etc., inheritance tax or gift tax will be imposed.

[Related laws and regulations, etc.]

Inheritance Tax Law 2, 2-2

Inheritance Tax Law Basic Understanding 11-2-1

Payment Services Act 2-5

Our comments:

This is a new item in Version 2.

I have no further comments regarding the tax treatment.

However, what is more important is to prepare carefully in advance before something happens.

If you keep your bitcoin on a domestic exchange, the transfer to your family will be smooth if your family knows the existence of the account.

It is not so easy in the case of a foreign exchange.

Furthermore, self-custody should be the default for bitcoin.

Leaving your bitcoin on an exchange is not recommended unless you are a trader.

If an exchange is hacked, you won’t get your bitcoin back.

And exchanges have been hacked and will be hacked in the future.

It is important to prepare for the worst case scenario, and ensure your family is informed of the storage location of wallets and how to use them, so that they can access your bitcoin in case something happens to you.

16 How to Measure Cryptocurrency Acquired Through Inheritance or Gift

Question

How can I measure cryptocurrency that I have acquired through inheritance or gift?

Answer

Cryptocurrency with an active market is measured based on the trading price at the time of the taxable event published by a cryptocurrency exchange where the taxpayer is trading.

Regarding the valuation method for cryptocurrency, since there is no provision in the valuation directive, it will be valued in accordance with the valuation method specified in the Valuation Directive 5 (Valuation of assets without specified valuation method) based on the objective exchange value established by active trading in which a certain market price is established.

In this case, for cryptocurrency with an active market(Note 1), the trading price at the time of taxable event published by a cryptocurrency exchange where the taxpayer is trading(Notes 2, 3, 4) will be used for valuation, similar to foreign currency.

For cryptocurrency without an active market, individual valuation will be conducted taking into consideration the content and characteristics, trading realities, etc. of the cryptocurrency(Note 5) as an objective exchange value cannot be established due to the lack of an established market price.

(Note)

1 “An active market” refers to a situation where sufficient quantity and frequency of transactions are carried out at a cryptocurrency exchange or a cryptocurrency sales venue, and price information is consistently provided.

2 “Trading price at the time of taxable event published by a cryptocurrency exchange” includes the transaction price recorded on a balance certificate provided by a cryptocurrency exchange in response to a request from a taxpayer.

3 In the case where both the purchase price and the selling price are published at a cryptocurrency exchange (cryptocurrency sales venue), it is not a problem using the selling price of the taxpayer.

4 If the taxpayer is conducting transactions with multiple cryptocurrency exchanges, it is not a problem to evaluate based on the transaction price at the time of taxable event published by the selected cryptocurrency exchange by the taxpayer.

5 For example, methods of evaluation such as considering actual transaction price and expert opinion can be considered.

[Related laws and regulations, etc.]

Valuation Directive 4-3, 5

Our comments:

This is a new item in Version 2.

An active market is defined as a market where there is a sufficient quantity and frequency of trades, but this definition is not very helpful because “sufficient” is not defined.

When looking at the trading screen of an exchange, the screen seems to be active with flashing prices, but most of the trades are actually made by liquidity providers.

When selling a large amount of cryptocurrency, the price will drop significantly.

bitcoin is the only cryptocurrency with enough liquidity to sell a large amount without affecting the market price.

When valuing cryptocurrency, it may be a good idea to consider a liquidity discount or consult with a valuation expert, if the amount is significant.

Income Tax Withholding

17 Payment of Salary, etc. Using Cryptocurrency

Question

Our company has decided to pay a part of our monthly salaries in a cryptocurrency that can be traded on exchanges, following a request from our employees.

How should we handle the withholding tax on this salary?

(Example)

On October 10, we paid 200,000 JPY in cash to an employee for their September salary and also paid part of the salary in a cryptocurrency (valued at 50,000 JPY at the time of payment) that the company owns.

Answer

The total amount of the employee’s salary is 250,000 JPY, consisting of 200,000 JPY in cash and 50,000 JPY in cryptocurrency.

Therefore, the total salary of 250,000 JPY should be used to calculate the withholding tax.

Salaries are usually paid in cash, but in cases like the one you mentioned, where a separate agreement is made in the employment contract to pay part of the salary in cryptocurrency, the value of the cryptocurrency payment should also be considered as part of the income from salary.

Therefore, as the withholding tax obligor, your company should calculate the withholding tax on the total salary, including the value of the cryptocurrency payment.

Note that for non-cash benefits-in-kind, the economic benefit should be evaluated, but in the case of cryptocurrency, the value at the time of payment should be used for evaluation.

[Related laws and regulations, etc.]

Income tax law 28, 36, 183

Our comments:

This is a new item in Version 2.

It is common to receive salary in bitcoin but the amount to be received is still denominated in fiat.

However, there are also bitcoiners who set their compensation denominated in bitcoin.

For example, hourly rate = 0.01 BTC, regardless of bitcoin price in USD.

As more people use bitcoin to measure the value of goods, bitcoin will become more accepted as a currency and not just an investment asset.

Consumption Tax

18 Treatment of Consumption Tax When Transferring Cryptocurrency

Question

Our company has transferred (sold) our cryptocurrency through a domestic cryptocurrency exchange. Can you explain the consumption tax consequences in this case?

Answer

The transfer of cryptocurrency through a domestic cryptocurrency exchange is not subject to consumption tax.

According to the Consumption Tax Law, the transfer of payment means and similar items is tax-exempt.

The transfer of cryptocurrency through a domestic cryptocurrency exchange is classified as the transfer of such payment means, and is therefore tax-exempt.

In addition, when filing a fixed tax return under general taxation, the tax base ratio is calculated based on the taxable sales, tax-exempt sales, and non-taxable sales for the relevant tax period, but the transfer of cryptocurrency that falls under the category of payment means does not need to be included in the calculation of the tax base ratio for non-taxable sales.

(Reference)

Fees paid to a cryptocurrency exchange as commission for the sale and purchase of cryptocurrency are considered as the consideration for the service of intermediation, and are subject to consumption tax.

In the case of using the individual correspondence method for reporting consumption tax for the fees incurred for the purchase of cryptocurrency for the purpose of buying and selling cryptocurrency, the tax on the purchase for tax purposes (i.e., tax-excluded sales corresponding to tax-included purchase) corresponds only to purchases other than transfer of taxable assets, etc.

The transfer of cryptocurrency made domestically before June 2017 is subject to consumption tax.

If a business operator subject to consumption tax has no choice but to record the name of the other party or the like in the books and request documents in order to apply for a deduction of the amount of tax on the purchase for tax purposes with regard to the purchase of cryptocurrency made domestically before June 2017 through an intermediary such as a cryptocurrency exchange, the books should be recorded to show the reason and the name of the intermediary.

[Related laws and regulations, etc.]

Consumption tax law 6-1, 30, Table 1-2 (Supplementary Table 1-2)

Consumption Tax Act Enforcement Ordinance 9-4, 49

Payment Services Act 2-5

Our comments:

This is a new item in Version 2.

I am really glad that the transfer of cryptocurrency is not subject to sales tax.

bitcoin is often referred to as digital gold because of its similarities with the metal.

Transfer (selling) of gold is subject to consumption tax.

This creates a difference between the price in Japan and the market price overseas.

If you buy gold overseas and sell it in Japan, you will earn a profit equal to the consumption tax.

In the case of gold, you will be taxed by customs when you bring it into Japan, but cryptocurrency is borderless.

We do not know how the price difference with foreign countries will affect price discovery of bitcoin in the long run, but it is good that there are fewer factors that could hinder natural price formation, even if only for a short period of time.

More importantly, bitcoin’s goal is to become the money of the future.

If sales tax was charged on transfers, maintaining transaction records would become too complicated and it would not function as a means of exchange.

It is fortunate that the authorities have settled on bitcoin being tax-exempt for consumption tax, in this respect.

Statutory Declaration

19 Whether to Include Cryptocurrency in the Property and Debt Statement

Question

I have cryptocurrency held at cryptocurrency exchanges in Japan and overseas.

Do I have to include cryptocurrency in the Property and Debt Statement?

Answer

Yes, cryptocurrency is subject to the Property and Debt Statement.

If you have cryptocurrency with property value as stipulated in Article 5 of Paragraph 2 of the Payment Services Act as of December 31, it will be necessary to record it in the Property and Debt Statement.

Cryptocurrency corresponds to “Other Property” in the Property Classification, so please record it by type of cryptocurrency (such as bitcoin), purpose, and location in the Property and Debt Statement.

The location of the cryptocurrency exchange where cryptocurrency is deposited does not affect whether or not it should be recorded in the Property and Debt Statement.

(Note) The location of cryptocurrency refers to the address (if you do not have an address, the residence) of the person who has the property, as stipulated in Article 3, Item 6 and Article 2 of the Remittance and Other Statements Regulations.

[Related laws and regulations, etc.]

Law Concerning the Declaration, Etc. of Foreign Exchange and Foreign Trade 6-2-1

Law Concerning the Declaration, Etc. of Foreign Exchange and Foreign Trade Administrative Order 12-2-6

Remittance and Other Statements Regulations12-3-6, 15-1-2, Supplementary Table 3

Payment and Services Act 2-5

Our comments:

This is a new item in Version 2.

Other than that it is better to keep bitcoin off of exchanges as much as possible, I have no particular comments.

For your information, the requirements for submitting a Property and Debt Statement are as follows:

Those who need to submit a Property and Debt Statement are those who are required to submit a tax return or those who are eligible to submit a tax refund application (only in cases where the total amount of tax for that year exceeds the total of the dividend deduction and the special deductions for year-end adjustments for housing loans, etc.), and meet either of the following conditions:

1 The total amount of various income except for retirement income for the year exceeds JPY 20 million.

The total amount of various income includes the total amount of income after deducting special deductions in cases where there is income subject to separate taxation. However, this does not include the carried-over deductions for (1) carry-over of net losses or miscellaneous losses, (2) carry-over of transfer losses in cases of replacement of residential properties, (3) carry-over of transfer losses for specific residential properties, (4) carry-over of transfer losses for listed shares, etc., (5) carry-over of transfer losses for shares issued by specific small and medium-sized companies, and (6) carry-over of losses for settlement of differences, etc. in futures trading, after the application of these deductions.

2 On December 31 of that year, you have assets with a total value of JPY 300 million or more or foreign-out special assets with a total value of JPY 100 million or more (assets acquired through inheritance or inheritance in the year of inheritance start can be excluded from the determination of the total value).

Here, “property value” refers to the total value of property value, not the amount subtracted from the property value by the amount of debt.

In addition, “Assets Subject to Special Cases for Moving Abroad” refers to the rights referred to in subparagraph 1 or 2 of paragraph 2 of Article 60 of the Income Tax Act or paragraph 3 of the same Article for unpaid credit transactions, etc.

(Note) For the Property and Debt Statement from the 5th year of the Reiwa era, in addition to the above, residents who have assets with a total value of JPY 1 billion or more as of December 31 of that year are also subject.

20 How to Record the Value of Cryptocurrency in the Property and Debt Statement

Question

How do I record the value of cryptocurrency in my Property and Debt Statement?

Answer

Regarding the value of cryptocurrency, if there is an active market, the transaction price published by the cryptocurrency exchange conducting the transaction for which the Property and Debt Statement is submitted will be recorded as the current market price as of December 31 of that year.

Also, if it is difficult to determine the market price, the estimated price will be recorded based on a reasonable method using the acquisition price or trading example price of the cryptocurrency as of December 31 of that year according to the situation of the cryptocurrency.

An active market for cryptocurrencies(Note 1) exists and a certain market price is established through active trading, and since the objective exchange value is made clear, the trading price(Note 2, 3, 4) published by the cryptocurrency exchange with whom the party submitting the Property and Debt Statement is conducting transactions shall be recorded as the market price as of December 31 of that year.

(Note)

“An active market exists” refers to the case where sufficient quantity and frequency of transactions are conducted on a cryptocurrency exchange or sales platform, and price information is continuously provided.

“The trading price as of December 31 of that year published by the cryptocurrency exchange” includes the trading price recorded on the balance certificate provided in response to the request of the party submitting the Property and Debt Statement.

If the purchase price and selling price are published on the cryptocurrency exchange (sales platform), it is acceptable to record the selling price of the cryptocurrency to the cryptocurrency exchange by the party submitting the Property and Debt Statement.

If the party submitting the Property and Debt Statement is conducting transactions with multiple cryptocurrency exchanges, it is acceptable to record the trading price as of December 31 of that year published by the cryptocurrency exchange chosen by the party submitting the Property and Debt Statement.

Furthermore, if it is difficult to calculate the value of a property listed on the Property and Debt Statement based on its market price, it is acceptable to calculate and record an estimated value.

The estimated value of a cryptocurrency refers to the value calculated using methods such as the following:

- The selling and purchasing actual price as of December 31 of that year (if there is no selling and purchasing actual price as of December 31 of that year, the selling and purchasing actual price within that year on the nearest date prior to December 31 of that year), among which the selling and purchasing actual price deemed appropriate

- If there is no value obtained in 1, the transfer price in the case of transferring the cryptocurrency from January 1 of the following year to the deadline for submitting the property and debt schedule

- If there is no value obtained in 1 or 2, the acquisition price.

[Related laws and regulations, etc.]

Law Concerning the Declaration, Etc. of Foreign Exchange and Foreign Trade 6-2-3

Law Concerning the Declaration, Etc. of Foreign Exchange and Foreign Trade Administrative Order 12-2-3

Remittance and Other Statements Regulations12-5, 15-4

Our comments:

This is a new item in Version 2.

I have no particular comments.

21 Whether to Include Cryptocurrency in the Foreign Property Statement

Question

I hold cryptocurrency on a foreign cryptocurrency exchange.

Do I have to include the cryptocurrency in the Foreign Property Statement?

Answer:

No, cryptocurrency does not have to be included in the Foreign Property Statement.

According to the provisions of Article 12, Paragraph 3, Item 6 of the Regulations on Property and Debt Statement for Foreign Transfers, etc., cryptocurrency falls under the category of property whose location is determined by the place of residence (if the party does not have a place of residence, their place of residence) of the party possessing the property.

In addition, the Foreign Property Statement is to be submitted by resident individuals (individuals who have a place of residence in Japan or who have continuously had a place of residence for more than one year, excluding non-permanent residents).

Therefore, cryptocurrency held on a foreign cryptocurrency exchange by a resident individual is not considered “property located abroad” and will not be included in the foreign property and debt schedule.

[Related laws and regulations, etc.]

Law Concerning the Declaration, Etc. of Foreign Exchange and Foreign Trade 5

Law Concerning the Declaration, Etc. of Foreign Exchange and Foreign Trade Administrative Order 10-7

Remittance and Other Statements Regulations12-3-6

Our comments:

This is a new item in Version 2.

I don’t have any particular comments other than that it is generally better to not keep bitcoin on exchanges as much as possible.

For more information on the requirement to submit a Foreign Property Statement, see below.

Requirement to submit

The parties required to submit a Foreign Property Statement are “resident individuals other than non-permanent residents” who have foreign property (excluding property acquired by inheritance abroad at the beginning of the year of succession) whose total value exceeds 50 million yen as of December 31 of that year.

Here, “resident individual” and “non-permanent resident” refer to those defined in the Income Tax Act, and the determination of whether an individual is a resident is based on their circumstances as of December 31 of that year.

According to the Income Tax Act, a “resident individual” refers to an individual who has a place of residence in Japan or has continuously had a place of residence for more than one year, and a “non-permanent resident” refers to a resident individual who does not have Japanese nationality and has a total period of residence or place of residence in Japan of five years or less within the past ten years.

Applicable Assets

The foreign property held as of December 31 of that year is the subject matter.

“Foreign property” refers to “property located abroad,” and the determination of whether property is “located abroad” is made on a case-by-case basis based on the circumstances as of December 31 of that year.

In addition, the “value” of foreign property is determined based on the “market price” or “estimated value” equivalent to the market price as of December 31 of that year, and the conversion into Japanese

Summary

The number of FAQ items has significantly increased in Version 2.

However, there has been no significant change in terms of tax implications compared to Version 1.

The comment below has been carried over from my closing summary for Version 1 (the names of the FAQ items have been updated to match those of Version 2).

bitcoin is an unique asset that has properties that have never existed before.

To make Bitcoin more understandable, existing things are used as analogies.

While analogies are useful in making things easier to understand, they do not necessarily accurately represent reality.

bitcoin is called a “coin”, but there is no physical coin and there is no issuer or administrator.

When we say that bitcoin is “sent” or “exchanged”, nothing physically moves.

People store bitcoin on “wallets”, but there is no bitcoin in the wallet itself.

If we apply analogies directly to accounting and tax calculation, there is a risk of failing to faithfully represent reality.

In this FAQ, I think that the following items in particular should be reconsidered to faithfully represent reality:

3 Crypto-to-crypto Trades => Change to taxable when exchanged for fiat;

5 Acquisition of Cryptocurrency Through Forks=> Change to taxable when exchanged for fiat or used;

6 Acquisition of Cryptocurrency Through Mining => Change to taxable when exchanged for fiat or used;

7 Income Classification of Cryptocurrency => Change to transfer income being the default;

Taxing when exchanging for legal currency more accurately represents reality and has the following effects:

- Simplifying taxable income calculation (benefit for both taxpayers and authorities);

- Improving tax capture rate and efficiency (benefit for authorities);

- Encouraging research, application, and improvement of new technology (benefit for the whole country)