CryptoGain is a Service That Will Make Tax Reporting of Cryptocurrency Trades Easy

For the past few months, we have been receiving an overwhelming amount of inquiries from individuals regarding the tax filing of gains and losses from cryptocurrency trades.

The tax rules regarding cryptocurrencies is nothing new and the tax authority’s stance is that tax returns should be filed applying the existing tax framework.

However, cryptocurrencies are new and guidance on how the existing tax rules should be applied to something new as cryptos is no doubt lacking.

The closest to thing to guidance that we can fall back on is the FAQ released by the NTA (National Tax Agency) in 2017.

https://www.nta.go.jp/shiraberu/zeiho-kaishaku/joho-zeikaishaku/shotoku/shinkoku/171127/01.pdf

The calculation method that is illustrated in this FAQ is not rocket science, but for traders that trade crypto among multiple exchanges, calculating the gains and losses for a year could definitely be a daunting task.

From early on, we understood the need for a service that would simplify the calculation of gains and losses from cyrpto trades.

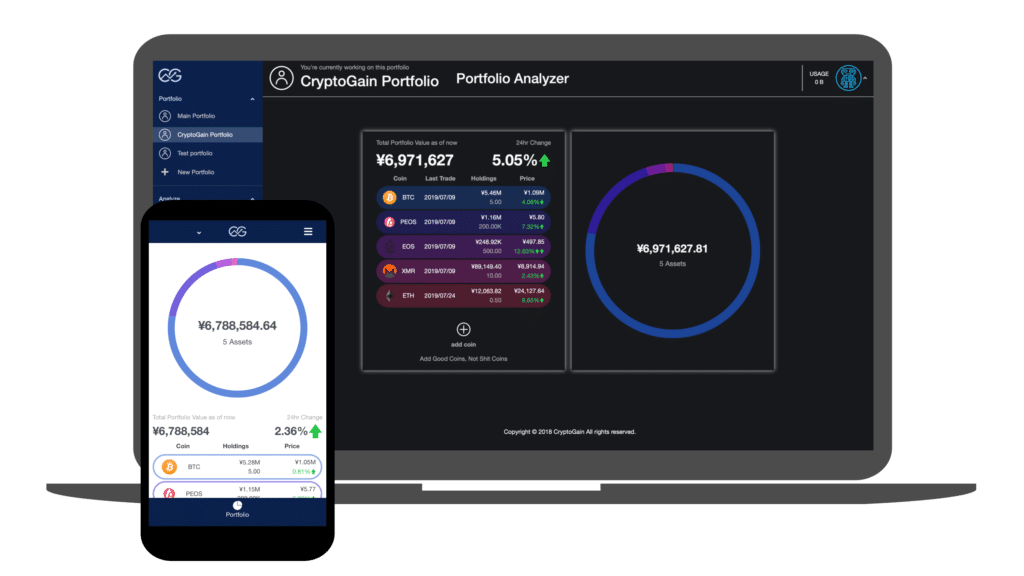

CryptoGain, the service that we are releasing today, was developed for that specific purpose.

The Features of CryptoGain

For details on CryptoGain, please see the material below.

The main three features are as follows:

- Top class coverage of exchanges (We are continuously adding exchanges)

- Easy to understand report (The calculation results will be delivered in an intuitive report format)

- CPA reviewed (The calculation logic and system coding has been developed by a CPA)

The service is still in beta because we are making updates (adding exchanges and trade patterns) almost every day and this requires (unfortunately) continuous bug squashing.

Our goal is to release the official service during 2018 after making improvements to the system reflecting on what we learned during the beta release.

Are You Interested in Using CryptoGain?

Reach out to us from our contact form or through the dedicated Discord.

The cost of 1 report is 40,000 JPY.

Individuals and CPAs are both welcome to use the service.

I am also taking basic accounting and tax inquiries related to cryptos without charge (as long as time allows!) so feel free to reach out.