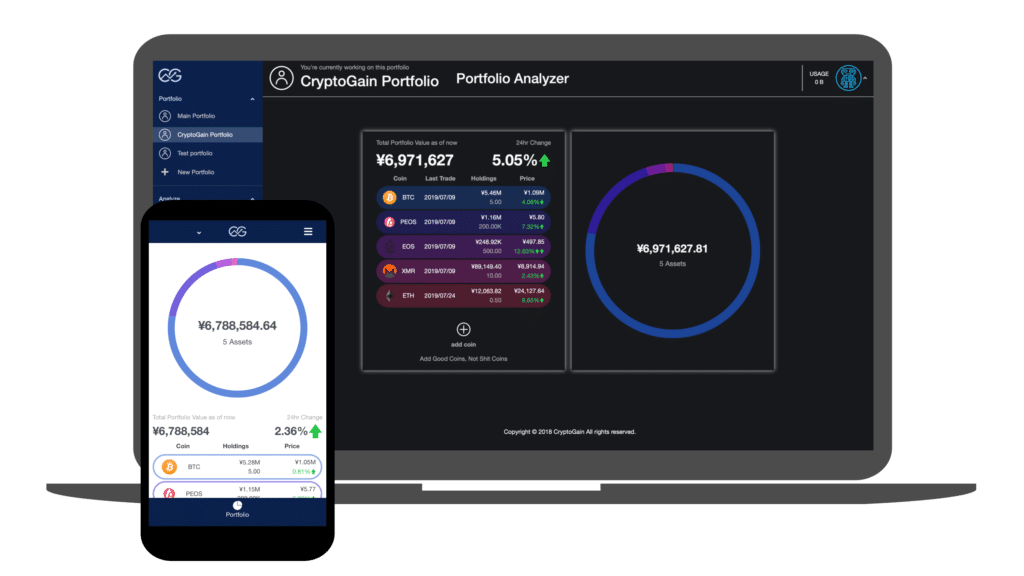

Some of the previous questions about calculating taxes for cryptocurrency have been clarified

On December 1, 2017, the National Tax Agency (NTA) published a guidance titled “Calculating taxable income related to Cryptocurrency (Information)”.

This is probably the first time that the NTA has officially expressed its views on calculating taxes for cryptocurrency in an FAQ format.

The reason why this FAQ is labeled as “information” is because it is not a law or regulation, but rather the view of the NTA.

Although it is not a law, the tax authorities in Japan will refer to this document when verifying the validity of tax calculations regarding crypto.

In practice, I expect various accounting and tax treatments to be based on this FAQ.

In this post, we will look at the contents of the FAQ one by one and add comments on any points of interest.

Our comments will be inserted using blue text, and the rest is the original content of the FAQ.

The official document can be obtained at the following link:

仮想通貨に関する所得の計算方法等について(情報)(平成29年12月1日)(PDF/238KB)

Calculating taxable income related to Cryptocurrency (Information)

Profits generated from the sale or use of cryptocurrency, including bitcoin, generally fall under miscellaneous income and require a tax return, unless they are generated as a result of actions that are part of various types of income such as business income.

This information (FAQ) is a compilation of information on the profits and losses of cryptocurrency that are subject to tax returns, and their specific calculation methods.

(Note 1) This information is based on laws and ordinances as of December 1, 2017. The examples used in this information (including trading amounts and markets) are fictional, but are based on the assumption of a typical transaction at an appropriate price.

(Note 2) For example, for those with year-end adjusted salary income who have cryptocurrency income of JPY 200,000 or less from the sale or use of cryptocurrency and no other income, a tax return is not required.

For cases where a tax return is required, please see http://www.nta.go.jp/taxes/shiraberu/shinkoku/tebiki2017/a/01/1_06.htm

Our comments:

According to the FAQ, profit from cryptocurrency is generally classified as ‘miscellaneous income’.

However, no reason is given for why this is the general rule.

Cryptocurrency clearly has asset value, and the act of exchanging it for other assets is considered a transfer of cryptocurrency.

Therefore, it seems normal to think that transfer income would be the general rule.

Such arguments are already being made among legal and tax experts.

Miscellaneous income has disadvantages compared to transfer income, such as not being able to net profits and losses with other income.

On the other hand, it is classified as miscellaneous income “unless it is generated as a result of actions that are part of various types of income such as business income.”

Therefore, if profit is being obtained from cryptocurrency as a business, for example, it could also be classified as business income or other income categories.

Whether it is a business or not is a subjective issue, and there is no clear numerical threshold or requirement, and it must be judged on a case-by-case basis.

If there are objective facts such as obtaining most of your income through bitcoin trading, and can be substantiated, it is likely to be easier to report as business income.

Note that this document is labeled as ‘information’ because it is the view of the National Tax Agency and is not a law, as mentioned earlier.

1 Sale of Cryptocurrency

Question

Please tell me how to calculate income when selling (converting to Japanese yen) cryptocurrency I hold.

(Example)

On March 9, I bought 4 bitcoin for JPY 2,000,000 (including transaction fees).

On May 20, I sold 0.2 bitcoin for JPY 110,000 (including transaction fees).

Answer:

When selling (converting to Japanese yen) the cryptocurrency you hold, income is the difference between the selling price and the acquisition price of the cryptocurrency.

In the above example, income is JPY 10,000 as calculated by the following formula:

JPY 110,000 [selling price] – (JPY 2,000,000 ÷ 4BTC) [acquisition price per bitcoin] x 0.2 BTC [bitcoin sold] = JPY 10,000 [income]

Our comments:

I have no particular comments regarding the method of calculating the profit when converting cryptocurrency to Fiat (legal tender).

It is noteworthy that transaction fees are included in the acquisition cost.

2 Purchase of Goods with Cryptocurrency

Question

What is the method of calculating income when purchasing goods with cryptocurrency I hold?

(Example)

I purchased 4 bitcoin for 2,000,000 yen (including transaction fees) on March 9th.

On September 28th, I paid 0.3 bitcoin (including transaction fees) to purchase goods worth 155,000 yen.

Answer

If you use the cryptocurrency you hold for payment when purchasing goods, the difference between the price of the goods at the time of purchase and the acquisition cost of the cryptocurrency will be the income.

In the above example, income is 5,000 yen according to the following formula:

155,000 yen [goods price] – (2,000,000 yen ÷ 4BTC) [acquisition cost per 1 bitcoin] × 0.3 BTC [bitcoin used] = 5,000 yen [income]

The “price of the goods” mentioned above refers to the total amount (including consumption tax) of the payment in Japanese yen if paid in Japanese yen.

Our comments:

I have no particular comments regarding the method of profit calculation.

However, it is not practical to calculate profit and loss every time one pays using bitcoin regularly in their daily lives.

Yes, it is true that the same tax rules apply to the use of foreign currencies.

But few people calculate and report exchange gains and losses when using foreign currencies during their holiday vacations in foreign countries.

We believe that a de minimis rule is necessary to exempt transactions below a certain amount.

3 Crypto-to-crypto Trades

Question

How does one calculate income when purchasing other cryptocurrencies using cryptocurrency I own (when exchanging cryptocurrency for cryptocurrency)?

(Example)

On March 9, I purchased 4 bitcoin for 2,000,000 yen (including payment fees).

On November 2, I used 1 bitcoin (including transaction fees) to purchase another cryptocurrency (the market value of the other cryptocurrency at the time of purchase was 600,000 yen).

Answer

If you use your own cryptocurrency to purchase another cryptocurrency, the difference between the market value of the other cryptocurrency at the time of purchase (purchase price) and the acquisition cost of the original cryptocurrency will be your income.

In the above example, income is 100,000 yen according to the following calculation:

600,000 yen [market value of the newly acquired cryptocurrency (purchase price)] – (2,000,000 yen / 4BTC) [acquisition cost per 1 bitcoin] x 1BTC [bitcoin sold] = 100,000 yen [income]

The purchase price refers to the total amount of cryptocurrency denominated in Japanese yen to purchase the other cryptocurrency.

Our comments:

I have no particular comments on the calculation method for profits related to crypto-to-crypto trades.

I believe most countries consider crypto-to-crypto exchanges as a taxable event.

However, I think a little more effort could have been made in the following two points.

First, it is often unrealistic or difficult to calculate gains and losses for each crypto-to-crypto exchange transaction.

In the case of listed stocks or FX, a transaction occurs and is completed within one brokerage account.

In this case, the calculation of trading gains and losses is easy and can be easily checked in most cases in the service provider’s user account information.

Even if one is using multiple accounts, one can generally determine the overall gain and loss by simply totaling the gains and losses of each account.

However, in the case of cryptocurrencies, one can freely send cryptocurrency between exchanges.

If one sends cryptocurrency purchased from one exchange to another exchange, the receiving exchange does not know the acquisition cost of the cryptocurrency.

Since there is no information on the acquisition cost, it is impossible for the receiving exchange to calculate gains and losses.

Therefore, it is not possible to determine the overall gain and loss by simply summing up the gain and loss data for each exchange if one is using multiple exchanges.

If one has a small number of transactions or is just using a few exchanges, one can use a spreadsheet to try to calculate gains and losses.

As the number of transactions or exchanges used increases, it becomes unrealistic or difficult to perform such calculations.

The second reason is a little more conceptual.

When exchanging one asset for another, the assumption is that it goes through yen once.

If there is a price difference between the assets being exchanged, a gain or loss is realized.

This is easy to understand when thinking of selling Apple stock to buy Google stock (both listed stocks).

One can’t trade AAPL with GOOG directly, they first sell AAPL for fiat, recognize any gain or loss at this point, and use that fiat to buy GOOG.

The thing with cryptocurrency is that BTC and ETH can be traded directly.

In most cases, users do not have the intention of realizing gains or losses when making these transactions.

Generally speaking, cryptocurrency does not give its holders any rights or represent any obligations, unlike financial products or fiat currencies .

In simple terms, holding cryptocurrency means holding a random string of characters called a Private Key.

Exchanging cryptocurrency for cryptocurrency is simply exchanging one string of characters for another.

It is similar to a person with an orange exchanging it for a person with an apple.

Even if the tax law is strictly applied in such a case, it may be subject to taxation.

But from a technical perspective, it seems awkward to me that merely exchanging a string of random letters would be considered a taxable event (this is akin to generating taxable events when exchanging email).

From a practical perspective and a conceptual perspective, I think it is appropriate to tax cryptocurrency when exchanged for fiat.

4 Acquisition Cost of Cryptocurrency

Question

I purchased additional cryptocurrency, how do I calculate the acquisition cost?

(Example of cryptocurrency transactions for one year)

On March 9, I purchased 4 bitcoin for JPY 2,000,000 (including transaction fees).

On May 20, I sold 0.2 bitcoin for JPY 110,000 (including transaction fees).

On September 28, I paid 0.3 bitcoin (including transaction fees) for a JPY 155,000 purchase.

On November 2, I paid 1 bitcoin (including transaction fees) to settle the purchase of another cryptocurrency (market value of the other cryptocurrency at the time of settlement was JPY 600,000).

On November 30, I purchased 2 bitcoin for JPY 1,600,000 (including transaction fees).

Answer

When acquiring the same cryptocurrency more than twice, it is appropriate to use the moving average method to determine the acquisition cost of the relevant cryptocurrency (however, it is also acceptable to use the weighted average method as long as it is applied continuously).

1) Acquisition cost per bitcoin using the moving average method

In the above example, the acquisition cost per bitcoin is JPY 500,000 on March 9 and JPY 633,334 on November 30, calculated using the following formula.

Acquisition cost per bitcoin for the portion acquired on March 9

JPY 2,000,000 / 4BTC = JPY 500,000/BTC

Sell or use 1.5BTC from March 10 to November 30

Book value of bitcoin held immediately before the purchase on November 30

500,000 JPY [the acquisition cost per bitcoin at this point] x (4 BTC – 1.5 BTC) [the number of bitcoin you own at this point] = 1,250,000 JPY

Purchase 2 BTC on November 30

The acquisition cost per bitcoin immediately after the purchase

(1,250,000 JPY + 1,600,000 JPY) [the total book value of the bitcoin you own at this point] ÷ (2.5 BTC + 2 BTC) [the number of bitcoin you own at this point] = 633,334 JPY

Note: Any fractions of less than 1 yen that occur in the acquisition cost calculation may be rounded up.

2) Acquisition cost per bitcoin using the total average method

The cost per bitcoin in the above example will be 600,000 yen, calculated using the following formula.

(2,000,000 JPY + 1,600,000 JPY) [the total acquisition cost of the bitcoin acquired over the course of one year] ÷ (4 BTC + 2 BTC) [the number of bitcoin acquired over the course of one year] = 600,000 JPY per bitcoin.

Our comments:

I have no particular comments about the calculation method of acquisition cost itself.

In the FAQ, both the moving average method and the total average method (with the condition of continuous application) are permitted, and the moving average method is considered “appropriate”.

However, there are other methods of calculating cost that are considered appropriate besides the moving average method and the total average method.

The first-in, first-out method and the individual cost method are examples.

In the United States, the first-in, first-out method is the basis for calculating the acquisition cost of cryptocurrency.

The individual cost method is also permitted under the condition that transaction records are properly maintained and the cryptocurrency itself that was the subject to the transaction can be uniquely identified.

Cryptocurrencies using the UTXO (Unspent Transaction Output) model, such as Bitcoin, allow individual identification of the cryptocurrency that was the subject of the transaction. (Ethereum is account-based and does not have UTXO, so it is not possible to individually identify the ETH that was the subject of the transaction)

Since the assets that were the subject of the transaction can be individually identified, it should be said that the individual cost method most accurately represents the cost and is most appropriate as the cost calculation method.

bitcoin is an asset with completely new properties that have never existed before.

Instead of simply applying the framework for existing assets, it is better to discuss how to faithfully represent the actual substance of the transaction.

The other point of interest is the section where it says “fractions of less than 1 yen that occur in the acquisition cost calculation may be rounded up”

If the cost increases, the gain will be calculated less, so the conclusion is that rounding up the fraction is advantageous.

Whether the moving average or the total average is advantageous is case-by-case.

Except in cases where the result is clear, it seems best to adopt the moving average method, considering the benefits of fraction rounding.

5 Forks

Question

If one acquires a new cryptocurrency that was born as a result of a chain fork, will this acquisition generate taxable income to be included in the tax return?

Answer

Under the Income Tax Act, when acquiring something with economic value, the income amount is calculated based on the market value at the time of acquisition.

However, regarding the new cryptocurrency acquired as a result of a chain fork mentioned in the above question, it is considered that there was no trading market at the time of the fork and the cryptocurrency did not have value at that time.

Therefore, no income will be generated at the time of acquisition, and income will be generated when the new cryptocurrency is sold or used.

In that case, the acquisition price will be 0 yen.

Our comments:

In the FAQ, it is stated that upon the fork, there is no market and the asset has no value, so the acquisition price is considered to be zero yen, and as a result, there is no income at the time of acquisition.

However, as the existing assumption is that, if an asset is acquired, the income amount is calculated based on the market value at the time of acquisition.

I consider applying this assumption to cryptocurrencies to be an issue in some cases.

Blockchain forks occur at certain frequencies due to how blockchains work.

For example when blocks are consecutively mined in a short period of time, this could lead to forks in the chain.

In the above example, the chain that is ultimately recognized as valid by the majority of nodes in the network is preserved, and the fork chain is discarded.

Therefore, new coins that have value do not arise from all forks.

However, many blockchains are open source and can be freely forked by anyone.

It is possible that a fork could occur without the taxpayer’s knowing.

The taxpayer could unknowingly acquire a cryptocurrency with value.

Also, even if a spot market did not exist at the time a new cryptocurrency was created, it is possible that a price for the cryptocurrency could be formed in a derivative market for the cryptocurrency.

As pointed out in the comments for FAQ 3, we believe that by taxing at the time of exchange for fiat currency or use, it simplifies the calculation of taxable income and protects taxpayers.

6 Income Classification for Income Related to Cryptocurrency

Question

According to Tax Answer, gains or losses (gains recognized in relation to the Japanese yen or foreign currency) resulting from the use of Bitcoin are generally classified as miscellaneous income. In what cases might they be classified as something other than miscellaneous income?

Answer

In general, gains or losses resulting from the use of cryptocurrencies such as bitcoin are classified as miscellaneous income, except when they are generated in conjunction with acts that are the basis for various types of income such as business income. For example, if a business income earner holds bitcoin as a business asset and uses it as a means of settlement, the profits generated from its use are considered income generated in conjunction with the business, so its income classification would be business income.

In addition, if it is objectively clear that the cryptocurrency transaction is being conducted as a business, such as if the income is used to support one’s livelihood, the income classification would also be business income.

The taxation relationship (income classification) for profits generated from using cryptocurrencies is also described in Tax Answer.

http://www.nta.go.jp/taxes/shiraberu/taxanswer/shotoku/1524.htm

Our comments:

Since the FAQ states that it is miscellaneous income “except when it is generated in conjunction with acts that are the basis for various types of income such as business income”, I think the point is that it can be reported as other income (business income or miscellaneous income) if it can be objectively proven.

On the other hand, the word “in general” is likely to be a hurdle in practice.

7 Netting of Losses with Other Income Classes

Question

I incurred a loss in the amount of miscellaneous income through cryptocurrency trading. Can this loss be used to offset other income such as salary income?

Answer

A loss incurred in the calculation of miscellaneous income cannot be used to offset other income.

Under the Income Tax Act, income that can be used to offset other income includes real estate income, business income, transfer income, and mountain forest income. Since miscellaneous income does not fall under these categories of income, a loss incurred in the calculation of miscellaneous income cannot be consolidated with other income, even if there is such a loss.

Our comments:

Same as the comment in the beginning and for FAQ 6.

While losses cannot from miscellaneous income can’t be used to offset income from other income categories, that changes if the income is classified as other than miscellaneous, such as business income or transfer income.

8 Cryptocurrency Margin Trading

Question

Will cryptocurrency margin trading be subject to the separate taxation system for declaration, similar to foreign exchange margin trading (commonly known as FX)?

Answer

Income from cryptocurrency margin trading is not subject to the separate taxation system for declaration, so it will be reported under the comprehensive taxation system.

Foreign exchange margin trading (commonly known as FX), which is the subject of your question, is a transaction regulated by the Financial Instruments and Exchange Act and is subject to the separate taxation system for declaration under the provisions of the “Special Provisions for Taxation of Miscellaneous Income, etc. related to Futures Trading” of the Tax Special Measures Law.

Under the Tax Special Measures Law, the special provisions for taxation of miscellaneous income, etc. related to futures trading (separate taxation for declaration) apply to 1) commodity futures trading, etc. based on the Financial Instruments and Exchange Act, 2) financial product futures trading, etc., and 3) the acquisition of covered warrants, and cryptocurrency margin trading does not fall under any of these transactions, so the separate taxation system for declaration does not apply and the income obtained from such transactions will be reported under the comprehensive taxation system.

Our comments:

I have no particular comments, but personally I am opposed to special tax treatments in general.

Lowering the tax rate is never a bad thing, but tax exemptions that favor only a certain group of people are not fair.

9 Cryptocurrency Mining

Question

Please explain how to calculate income from mining cryptocurrency.

Answer

If you acquired cryptocurrency through mining, the income from it is considered either business income or miscellaneous income. In this case, the amount of income is calculated by subtracting necessary expenses (costs incurred through mining or other means) from the amount of revenue (the market value of the cryptocurrency at the time it was acquired through mining or other means). If you sell or use the cryptocurrency you acquired through mining or other means, the acquisition price cost to calculate the income would be the market value of the cryptocurrency at the time it was acquired through mining or other means.

Our comments:

It seems like a reasonable conclusion at first glance, but upon further thought, there appears to be a few issues.

If one interprets receiving bitcoin (cryptocurrency) as payment for providing the service of mining, then yes, the received bitcoin would be considered income.

However, mining itself is not a service, and there is no organization like a company or individual that can be considered the recipient of the service.

Mining bitcoin is merely generating random numbers using a computer.

It is called mining as an analogy because it shares certain similarities as gold mining.

Gold mining companies and oil mining companies do not consider mining gold or oil itself as their business.

They consider selling the mined commodities as their business and income tax is also recognized not at the time of mining, but at the time of sale.

If we think of bitcoin mining in the same way as commodity mining, it seems reasonable to recognize taxable income at the time of sale or use, not at the time of mining.

Summary

bitcoin is an unique asset that has properties that have never existed before.

To make Bitcoin more understandable, existing things are used as analogies.

While analogies are useful in making things easier to understand, they do not necessarily accurately represent reality.

bitcoin is called a “coin”, but there is no physical coin and there is no issuer or administrator.

When we say that bitcoin is “sent” or “exchanged”, nothing physically moves.

People store bitcoin on “wallets”, but there is no bitcoin in the wallet itself.

If we apply analogies directly to accounting and tax calculation, there is a risk of failing to faithfully represent reality.

In this FAQ, I think that the following items in particular should be reconsidered to faithfully represent reality:

- 3 Crypto-to-crypto Trades => Change to taxable when exchanged for fiat;

- 5 Forks => Change to taxable when exchanged for fiat or used;

- 6 Income Classification for Income Related to Cryptocurrency => Change to transfer income being the default;

- 9 Cryptocurrency Mining => Change to taxable when exchanged for fiat or used

Taxing when exchanging for legal currency more accurately represents reality and has the following effects:

- Simplifying taxable income calculation (benefit for both taxpayers and authorities);

- Improving tax capture rate and efficiency (benefit for authorities);

- Encouraging research, application, and improvement of new technology (benefit for the whole country)